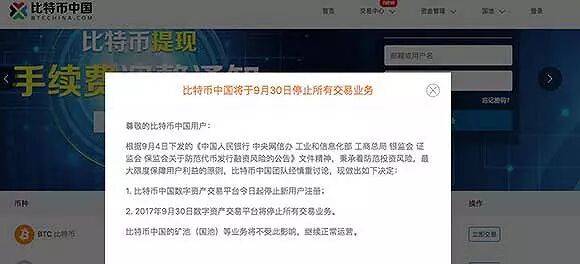

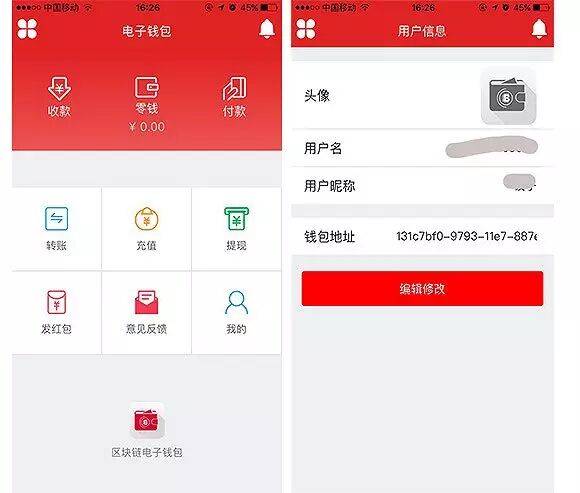

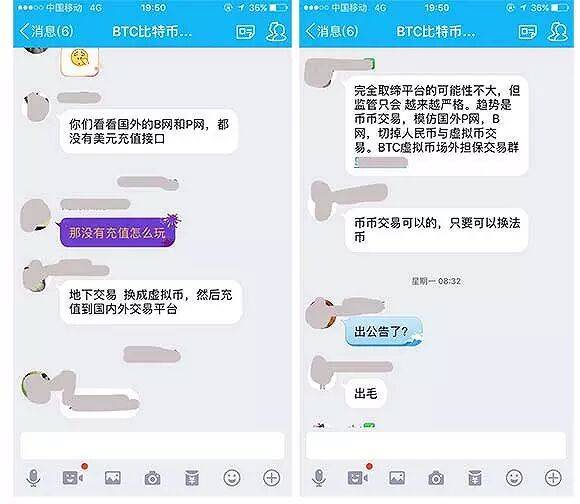

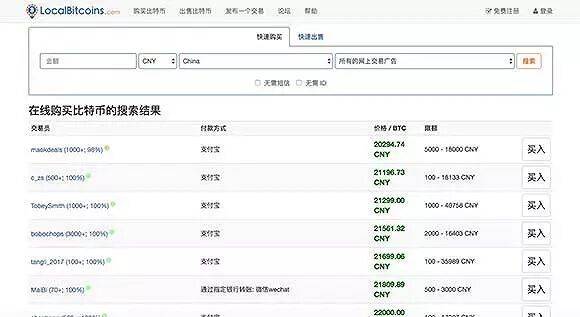

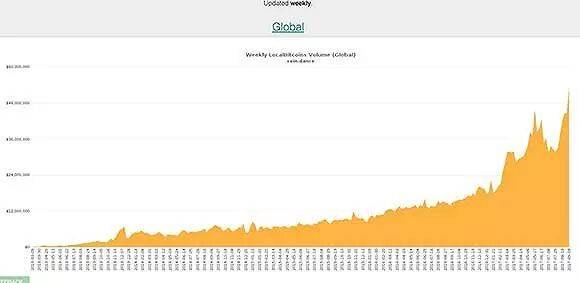

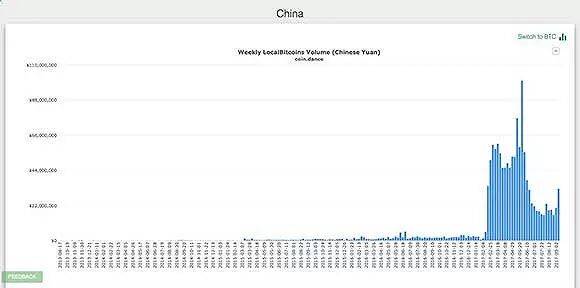

Some people have lost all their wealth to speculate in currencies, and now they are in a dilemma; Some people liquidated their positions overnight and suffered huge losses. Author | Wang Fujiao Bitcoin had a terrifying night. At 7 pm on September 14, “Bitcoin China”, one of the largest domestic Bitcoin trading platforms, announced that the digital asset trading platform will stop new user registrations starting today.; The digital asset trading platform will cease all trading operations on September 30, 2017.  As soon as the news came out, the entire digital currency trading market was shaken. This is considered to be a prelude to the enforcement of Bitcoin trading regulations. Previously, Caixin reported on September 8 that the central bank would standardize the management of Bitcoin trading platforms and shut down all Bitcoin-to-legal currency (RMB) transactions. As of the press time of Jiemian News on the evening of September 14, Bitcoin had fallen by more than 30%, Litecoin had plummeted by 57.3%, and Bitcoin Cash had plummeted by 60.62%. Various other digital currencies have fallen by more than 60%. This situation did not occur during the previous clean-up of ICOs, and the entire market trend can be described as "crazy".  Bitcoin trend  Litecoin trend A few hours later, the market as a whole was slightly higher. The domestic price of Bitcoin rebounded to around 21,000 yuan. However, the trading volume on the market was in the order of hundreds of thousands, and a large number of sales and transactions occurred. As soon as supervision comes out, all living things will change. There was a cry in various Bitcoin trading chat rooms: Some people have lost all their wealth to speculate in coins, and now they are in a dilemma ; Someone liquidated their positions overnight and lost hundreds of thousands. ; Various OTC trading groups became active instantly. Some people left WeChat IDs everywhere, "We sincerely accept all kinds of coins that have been removed from the shelves and cannot be traded." This made people angry and hateful. ; Some people even believe that the time has come for bargain hunting.  ▋True and false regulatory rumorsBitcoin, an essentially "decentralized" digital currency, is very sensitive to any disturbance. Because there is no unified supervision by the central bank and the setting of price limits, any rumors about supervision will cause the price of Bitcoin to rise and fall like a roller coaster. The latest time was after seven ministries issued documents to crack down on ICOs. Although Bitcoin is not a digital currency issued by ICOs, it still fell by nearly 17%. Since September, Chinese regulators have first banned ICOs and then shut down domestic Bitcoin exchanges. The supervision of digital currencies has exceeded expectations. This regulation directly caused the price of Bitcoin to plummet. According to worldcoindex data, since September 1, Bitcoin has fallen from US$4,800 to US$3,655, a drop of 24%, and its market value has shrunk by nearly US$20 billion. In fact, if strictly speaking, the shutdown of transactions on the Bitcoin China platform on September 14 was also a spontaneous act and was not a "real hammer" under the announcement of the national regulatory agency. There may still be a chance of luck here. A VC close to the Shanghai Finance Office told Jiemian News, “In fact, Bitcoin China has also been interviewed by the Shanghai Finance Office, and other platforms will also take action one after another. There is no formal announcement to give the market time to buffer. ” Bitcoin China is a company registered in Shanghai, which also confirms the person’s view from the side. According to previous reports by China Business News, the buffer period given by financial regulators to major platforms is until the end of September. Even if the central bank issues supervision and interview requirements, a reasonable buffer period is still needed. A person in charge of a Bitcoin trading platform told Jiemian News that the chances of meeting with the Financial Office have been significantly higher recently, but he still has not received a clear regulatory notice. Wu Huawei, co-founder of China Bitcoin, told Jiemian News: “Bitcoin is a digital asset based on blockchain technology. At this stage, it may cause bubbles due to market overheating, but we should think about whether it has value. The development of blockchain is the trend of the times, and I guess that supervision at the national level must be carefully considered. ” On the evening of September 13, the China Internet Finance Association issued a risk warning stating that so-called "virtual currencies" such as Bitcoin are increasingly becoming tools for illegal and criminal activities such as money laundering, drug trafficking, smuggling, and illegal fund-raising, and investors should remain vigilant. The Shanghai Stock Exchange also previously issued an article saying that regulators will ban domestic virtual currency trading venues and have interviewed relevant platforms. It’s not like there’s no good news. On September 12, People's Daily Online published an article titled "In applause for the ban on ICOs, the next step should be to strengthen the supervision of Bitcoin trading platforms." In addition to taking stock of the results of ICO liquidation, it also clarified the difference between financing and technology. It is proposed to "allow the development of blockchain projects with real technical connotations." It is to "justify the name" of Bitcoin and blockchain technology. People’s Daily Online pointed out, “Strengthening the supervision of Bitcoin trading platforms and promoting the standardization of virtual currency transactions should be the next step for supervision. ” A less noticed signal is that not long ago, Bank of China quietly launched a “blockchain electronic wallet” which can be found in the App Store. Each registered user can be assigned a wallet address.  On the surface, it looks more like a rough version of Alipay, and its actual utility cannot be seen. However, this is considered to be a sign that major state-owned banks will bring Bitcoin trading under supervision, and may adopt management methods similar to those of stock exchanges in the future. ▋The blood and tears of retail investorsAmid this regulatory storm of digital currency transactions, a young man from a small town, Shan Dan (pseudonym), said that he is a living history of blood and tears for retail investors. Shan Dan also couldn't figure out whether the regulatory news was true or false. He discussed it with several friends who were currency traders and thought that the regulation might not block all major platforms. “Is the news true or false? I don't care if it's true or not, I'm in a really bad mood right now. ” In 1986, Shan Dan was born in a fourth-tier city in Hubei, with an average monthly salary of less than 5,000 yuan. He jointly mined with his friends and also speculated in coins himself. In his early years, he didn't go to college and opened an Internet cafe in his hometown. Later, the Internet cafe business became difficult, so he invested the hundreds of thousands he earned in the early stage into the digital currency business. It can be said that he invested his entire wealth. “I feel like Bitcoin cannot be banned. Nowadays, mainly young people are speculating on these coins. Everyone knows that money comes quickly and conveniently. You can trade 24 hours a day, unlike the stock market, which is closed or something. ”Said the single. The entry process was simple and clear, and I had a good friend who was working in this industry at the time. Just chat and learn with him. I also read some books and thought I could make money, so I started doing it. “Young people all want to have a go, and who doesn’t want to make money? ” He has a clear understanding of mining and currency speculation: “Mining is like going to work, and currency speculation is like playing mahjong. ”He knows that mining will definitely produce results if there is investment. They are mining Ethereum. When they first started at the beginning of this year, they could mine 40-50 coins in 24 hours. Now there are more and more miners, and the number has dropped to 7-8 coins per day. However, it is still stable. There is an inverse relationship between output and currency price, and it continues to be stable at return on capital. Shan Shan originally planned that the mining investment invested by several of them would recover the cost within one year, but with the current state of the digital currency market, the recovery time will take two years or even longer. If we say that mining is still going on steadily. Coin speculation is different, the game is about heartbeat. On September 14, after the regulatory order of seven ministries and commissions on ICO was issued, the price of digital currency plummeted. I couldn’t stand the single anymore, so I threw away all the BTS I bought on Yunbi.com. “Last night (September 14th), I didn’t have to throw it away, I could just transfer it to another platform. But let me think about it. I ran away more than 14,900 coins. In May this year, I bought it for 9 cents, and yesterday I sold it for 0.55 cents. Feeling very bad. ”Qu Dan said that he had lost nearly 20,000 yuan by speculating on coins with his "playing mahjong" mentality. “How do you know when that point is the end? ”the reporter asked. “For us retail investors, there is never a bottom. It’s just that you have the confidence in your heart. This is really a very serious and big blow to retail investors. ” Single recalled that he entered the market in May and has only experienced two big plunges to this day. The rest of the time it has been stable and rising. Only once did it fall by more than 50%, and it was pulled up on the same day. The losses of the mining company I opened with my friends are even more immeasurable. They use ordinary computers that have been modified to dig, and they run the machine 24 hours a day without daring to stop. But after digging it out, I watched the price of the coin drop. The currency mined by the single is called Ethereum (ETC). It was 34 yuan in May, slowly rose to more than 50, and then was instantly pulled to more than 100 during a certain period of time. This digital currency, an upgraded version of Bitcoin, is the most successful digital currency after Bitcoin because it supplements smart contract technology. In order to invest in output in the early stage, we dug it up and sold it. Now, the single has registered an account on the Ethereum official website, and the coins mined are placed in the official wallet, and will be traded after the price stabilizes. If the regulation is really implemented, trouble for singles will still lie ahead. He plans to trade on the foreign B network (Bitfinex) and P network (Poloniex). Their status in the international trading market is equivalent to OKCoin and Yunbi.com. But the difficulty is that B network and P network do not support RMB transactions, and Single does not have a foreign bank account. “The whole circle is discussing this matter. But now we can only wait for supervision to see how it goes, there is no other way. I can only sit back and wait, take it one step at a time, and let nature take its course. ”Said the single. ▋OTC trading is going crazyLike a single, if there is demand, new markets will naturally emerge. Once the exchange is blocked and the threshold for "decentralized" Bitcoin transactions is raised, it will become difficult for people to speculate in the currency. On the evening of September 14, several Bitcoin over-the-counter trading groups where Jiemian News reporters belong were particularly active. The group is discussing whether supervision is really coming, the process of OTC trading and what kind of guarantee the group owner can provide.  In the Bitcoin industry, the main channels for over-the-counter (OTC) transactions include information intermediary platforms self-operated by institutions, information intermediary alliances self-operated by institutions and licensed to join, and WeChat groups and QQ groups led by individuals and micro-teams. According to the mode of providing services, it can be divided into two categories: B2C and C2C. The group owner of one group said: “The group owner can provide private transactions in Bitcoin and Litecoin, and the group owner guarantees it. ”However, the method of guarantee and the source of currency were not specified. One player even asked directly in the group, "If the group leader runs away, won't we lose all our money? ” Another "guaranteed transaction group" provides a detailed OTC transaction process: the buyer and seller first negotiate the price - both parties contact the group leader - the buyer pays the group leader for guarantee - the seller pays coins to the buyer - the group leader pays the buyer money (1 block confirmation) - the transaction is completed. Those who have the methods and channels will want to replace the exchange and cast themselves as a "guarantee". However, the exchange is a platform and has a long-term stable existence. How to ensure the identity of the group owner? Group owners usually set some rules: such as free price negotiation, but it is recommended to focus on mainstream domestic and foreign trading platforms.; When buyers and sellers contact the group owner, they need to provide the payment account and wallet address for easy inquiry, but promise to keep the transaction information confidential. ; In order to reduce time, after the seller transfers the currency, the guarantor transfers the money to the buyer in one block. In an over-the-counter trading group that Jiemian News reporter belongs to, the handling fee charged by the group owner is two thousandths, which is lower than five thousandths of that of Yunbi.com. Under normal circumstances, the group information will come with a free circumvention VPN and the URL of Bilibili and Pilibili. If you search in WeChat and QQ groups, there are hundreds of such OTC trading groups.  According to a previous report by the Financial Times, the "How To Buy Bitcoins" website shows that, including over-the-counter transactions, there are more than 31 ways for users around the world to buy Bitcoin. In the B2C model, LocalBitcoins.com, the Bitcoin over-the-counter trading platform with the widest coverage, has provided Bitcoin purchase services to users in more than 14,000 cities in 245 countries, including RMB users.  Open the official page, select RMB buy, and you can see sellers who are willing to sell coins. The payment method can accept Alipay, WeChat payment or domestic bank transfer, which couldn't be more convenient.  According to data from the coin.dance third-party data platform, the global Bitcoin trading volume on LocalBitcoins has been showing a stable and continuous upward trend.  The situation in the Chinese market is that in 2017, there was a surge in growth that was different from the changes in global trends. The two most obvious changes were in February and June 2017. These two special time nodes were when Chinese regulators conducted on-site supervision of Bitcoin trading platforms in China.  In February 2017, various trading platforms suspended Bitcoin withdrawal services due to upgrading anti-money laundering systems. This business adjustment of China’s on-site trading platform directly contributed to the 42-fold increase in RMB trading volume on the LocalBitcoins website. Calculated based on the average Bitcoin market price in February 2017, the monthly RMB transaction volume of the OTC trading platform in that month exceeded RMB 400 million. In June this year, there was news that the "Bitcoin Trading Platform Management Measures" may be released. ▋Foreign markets and attitudesAccording to Bloomberg, the market share of the virtual currency market in China is around US$150 billion, and Chinese Bitcoin transactions account for approximately 23% of global transaction volume. In recent days, criticizing Bitcoin seems to have become a trend. On September 6, Business Insider reported that Robert Shiller, the Nobel Prize winner in economics who accurately predicted the two largest speculative markets in recent history, reiterated that Bitcoin is a bubble. Marko Kolanovic, global head of quantitative and derivatives strategy at JPMorgan Chase, commented on Bitcoin on Wednesday:

He also said that other governments are likely to follow China's footsteps and outlaw digital currencies. In the report, JPMorgan Chase mentioned in detail the difference between encrypted digital currencies and traditional currencies: apart from speculation, there are few legitimate reasons to use cryptocurrencies (for example, any transaction can be conducted electronically in national legal currencies such as US dollars or euros). Arguments that cryptocurrency transaction costs are lower are inaccurate given that they are almost always driven by their volatility, rather than transaction fees. Taking Bitcoin as an example, its volatility is about 100%, which is 15 times the average of other currencies. It is extremely unstable. The British Financial Conduct Authority (FCA) stated in an announcement on the 12th that ICO is a "highly risky speculative investment." However, in the international market, there are also countries that standardize the operation of digital currencies through supervision. The Korean Bitcoin Exchange is one of the few major cryptocurrency trading sources, with huge trading volumes on Bithumb, Coinone, Korbit and other platforms. Although South Korea has not affirmed the legal status of Bitcoin. However, in the case where the local police confiscated 216 Bitcoins from a suspect, the local court clearly stated that the seizure of Bitcoin assets was illegal. In South Korea, there are already projects such as ENT Cash that use blockchain technology for celebrity transactions, and there are specific implementation scenarios available. Japan, Singapore, and Australia are relatively friendly to Bitcoin. On April 1 this year, Japan’s revised “Payment Services Act” officially came into effect, defining digital currency as a legal payment solution, exactly the same as the management of local payment companies in Japan. This amendment bill also amends the Criminal Proceeds Transfer Prevention Act, requiring Bitcoin exchanges to implement stricter KYC policies (Know your customer) than currently available. Exchanges must begin verifying the identities of users who open accounts, keep transaction records, and report suspicious transactions to regulators. In an interview with a reporter from Jiemian News, Xu Zijing, founder of Australia's Branch Bank Capital, said that all digital currencies in Australia require a financial license in accordance with the country's anti-money laundering requirements.; The Singapore government defines it as a commodity. In the United States, digital currencies are defined as securities. In July 2017, the U.S. Securities and Exchange Commission issued a notice stating that digital assets issued and sold by virtual organizations would be included in the scope of federal securities law supervision. However, the situation in each state in the United States is different and more complex. According to Xu Zijing, the United States was the first to try to define Bitcoin as illegal, resulting in a large number of underground black markets that only use Bitcoin for transactions. The final approach of the United States is to give Bitcoin a legal Bitcoin banking license. Bitcoin-related institutions need to pay corresponding deposits and industry due diligence, and there are also regulatory requirements for anti-terrorism and anti-money laundering. History always repeats itself. When talking about the topic of Bitcoin, the industry-accepted view is that "the development of blockchain is an inevitable trend." The most important application of blockchain, Bitcoin, has been exploited by hackers and money laundering organizations because of its decentralized and encrypted properties. What is needed is effective and reasonable supervision. It can be observed that every time uncertainty occurs, the Palestinian-Israeli conflict intensifies, or a global ransomware virus breaks out, the price of Bitcoin will rise. In the final analysis, Bitcoin is a trust mechanism that solves the problem of people's trust in the world. “Everyone's panic is phased. But I think the development of this industry will not change much in the long run (the entire global market). ”Wu Huawei, co-founder of Bitcoin in China, said, “As I said before, the important thing is to look at the value of Bitcoin itself. ” Just like Bitcoin players who experienced 2013 will not forget that at that time, the "Silk Road" was seized by US law enforcement agencies and 26,000 Bitcoins were seized at the same time.; Not long after 2013, Bitcoin Central, the first exchange to reach an agreement with a bank, was hacked, and the price of Bitcoin dropped to around $100. On December 5, 2013, China’s Bitcoin market experienced a major shock. Five ministries and commissions of the central bank issued the "Notice on Preventing Bitcoin Risks." In this document, compared with the financial restrictions on Bitcoin in the United States, the central bank order stipulates that Bitcoin is only a "virtual commodity" in China, not a currency, and prohibits financial institutions, including banks and insurance, from intervening in Bitcoin transactions in any form. At that time, the central bank’s requirements for Bitcoin trading platforms were: “Trading websites operate legally within the prescribed scope. ”This notice not only shows the attitude, but also stimulates the market’s expectations for the future of Bitcoin. But after the central bank document was issued, no one studied the document seriously. Within 15 minutes, the market value of Bitcoin dropped from 7,000 yuan to 4,000 yuan, a drop of 35%, and speculators fled. Only those who truly believed in the value of Bitcoin did not sell and saw it recover from 2013 to a high of more than 20,000 yuan in 2017. There are certain technical thresholds for the use of Bitcoin, but the closure of exchanges will not make Bitcoin truly untradeable. Rather, it allows some irrational investors to exit the market. This is when the bubbles really begin to be removed. The most subtle thing is that this round of regulatory bans is precisely the "central position" of Bitcoin exchanges. Bitcoin is about to get rid of the bubble of speculation and return to its "decentralized" nature. ·END·  ▽Click "Read the original text" to download the Interface News APP |

2025-10-19