68054

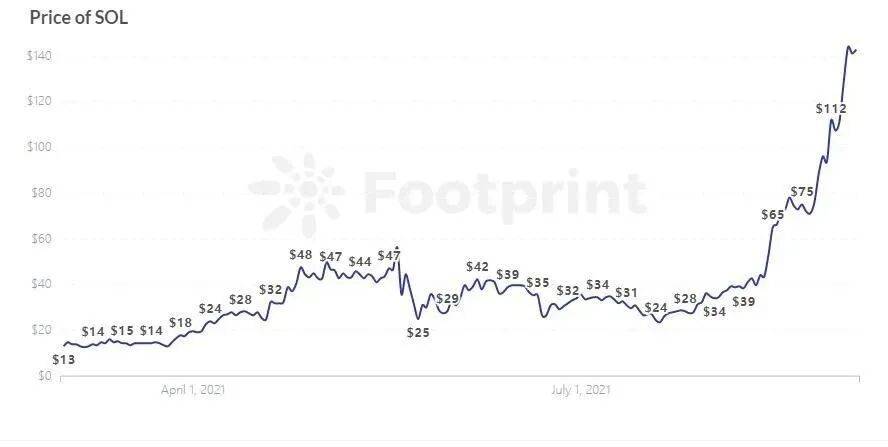

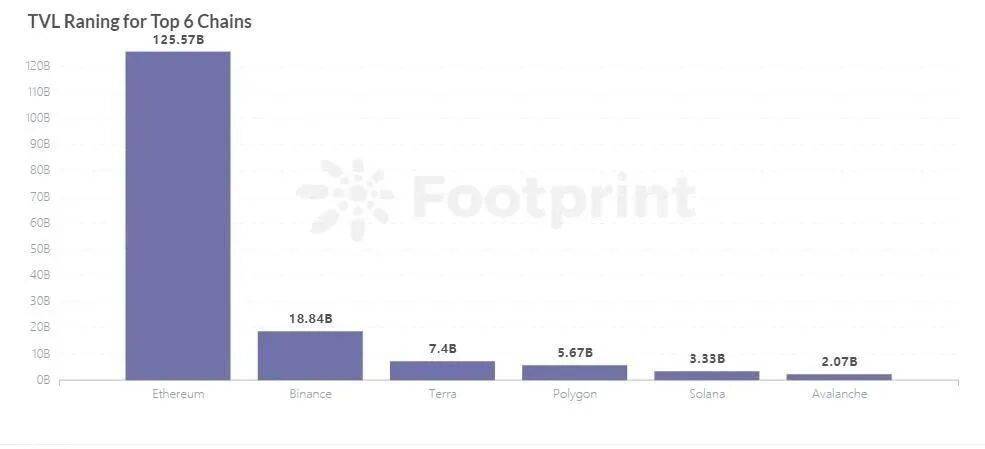

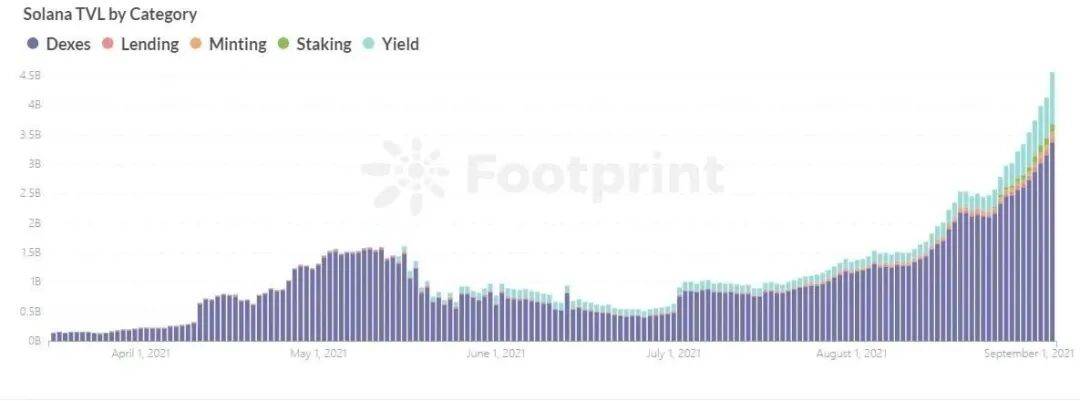

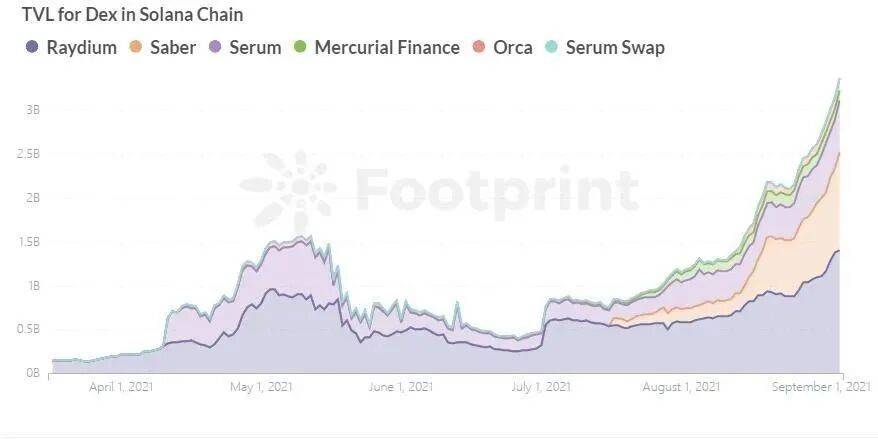

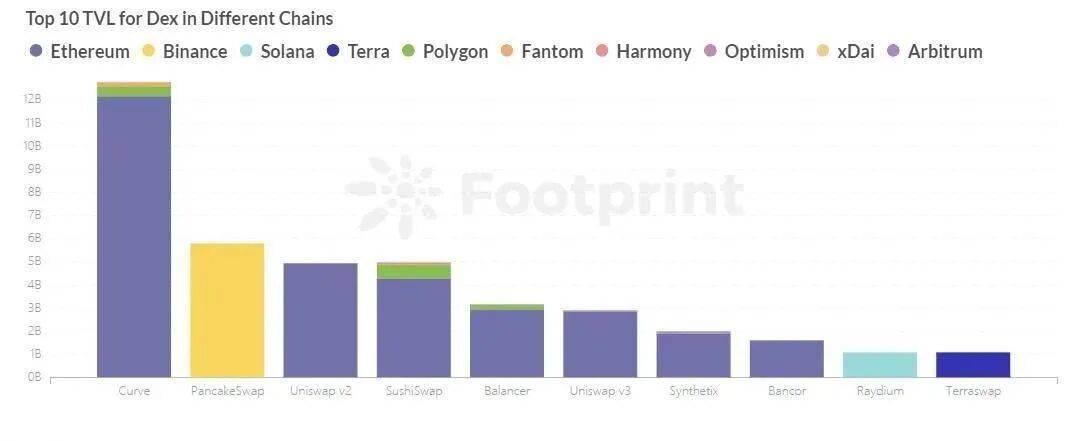

“For an overview of Solana's ecology, click on the article: Solana is gradually gaining momentum, and a partial overview of the ecology is available. Its rich ecosystem and good performance have attracted more and more users. As a public chain, Solana has outstanding performance in two aspects: 1. The currency price has risen rapidly, exceeding 112 US dollars in August, and the current data has increased by 208.9% compared with the beginning of August. ; 2. The ecosystem on the Solana chain is growing rapidly. The decentralized streaming media service Audius has established a cooperative relationship with TikTok. This cooperation model has attracted a large number of users to the project and even the chain. Let’s analyze it from multiple angles: Why can Solana shine among many public chains?  Solana token SOL currency price changes, data source: Footprint Analytics (1) An increasingly complete ecological system Unlike other public chains, Solana’s development strategy is to first improve its technical level and consolidate its infrastructure. Solana attracts engineers with strong technical backgrounds such as Qualcomm and Intel to provide it with strong technical talent support. Through eight innovative technologies such as sea level (parallel smart contract), cloud dispersion (horizontally expanded account database), and archives (distributed ledger storage), Solana alleviates the impossible triangular problem of blockchain security, scalability, and decentralization. In addition, by carrying out activities combining foundations and hackathons, it explores a large number of valuable and potential projects to keep them in the ecosystem. With the explosion of ecology, the chain's ecosystem has gone from being a handful to now covering various tracks, gradually forming a powerful system composed of 332 projects in 24 fields such as DeFi, Tools, Infrastructure, NFT, Games, Wallets, DApp, Developer tools, etc. The ecosystem is gradually becoming more complete. (2) Efficient trading performance Mainly reflected in: low transaction fees and efficient transaction speed. In order to solve the problems of transaction congestion and high transaction fees on the chain, Solana adopts a PoH (Proof of History) mechanism that is different from other public chains. This mechanism solves the problem of slow efficiency caused by complete synchronization of the timestamps of each block in the distributed network. By allowing each node to generate a local timestamp, data updates and data status processing do not need to wait for the synchronization of the entire blockchain network to ensure that transaction verification time is shorter, thereby improving transaction processing efficiency and security. The PoH mechanism can handle up to 65,000 transactions per second. This throughput is much higher than the 100 transactions/second of the Binance Smart Chain and the 15 transactions/second of the Ethereum Chain. ; With the improvement of processing efficiency and reduction of energy consumption, Solana's average transaction fee is US$0.00025/transaction, which is about 80,000 times higher than the Ethereum chain's US$20/transaction. Solana's low transaction fees and efficient transaction speed not only lower the transaction threshold for DeFi users, but also attract more project parties to develop in the Solana ecosystem and more users to trade on this public chain.  TVL ranking of different public chains, data source: Footprint Analytics (3) Solana’s total locked-up volume (TVL) soars From the perspective of TVL, although the Ethereum chain still maintains its leading position and occupies a large market share, from the perspective of the development speed of each public chain, Solana's growth rate ranks among the best. In early June, with the news that Solana received US$314 million in financing led by a16z and Polychain, Solana, a public chain, once again attracted attention. In just 3 months, the public chain's TVL has achieved a 232% increase, occupying 1.8% of the market share. The most outstanding performance was in August, with an increase of 138.8%, surpassing the Huobi Ecological Chain (Heco), and temporarily ranking among the top five public chains.  Solana public chain TVL changes, data source: Footprint Analytics (4) The DEX platform has become a prominent contributor to Solana TVL, and multi-category DeFi applications are flourishing. With the fission explosion of Solana ecological applications, all major fields are contributing to the growth of the public chain TVL. The most prominent contribution to TVL is the DEX platform, with a high share of 78.4%, occupying the dominant position in DeFi applications. DEX platforms are currently leading the Solana ecological applications. With the entry of more application platforms, such as the Lending platform Mango Markets in April, the Yield platform Solfarm in May, the Minting platform Parrot Protocol in June, and the Staking platform Marinade Finance in August, the proportion of DEX platforms on the Solana chain in TVL is gradually declining. I believe that as more types of DeFi applications enter Solana in the future, A hundred flowers will bloom.  Solana public chain DEX platform TVL changes, data source: Footprint Analytics (5) Raydium becomes the leader of Solana ecological DEX platform, and Saber’s growth rate is as high as 425% The development of the Solana ecological DEX platform has accelerated since June. Within 3 months, the number of DEX platforms online increased from the initial 3 to 6, and TVL also increased from US$830 million to US$2.61 billion, an increase of 214.5%. Among them, Raydium, as the first DEX platform on the Solana chain to use the AMM mechanism, has gradually expanded its TVL advantages in the process of creating liquidity for the entire Solana ecosystem and continues to become the leader of the DEX platform on the Solana chain. As a cross-chain exchange, Saber has become more and more demanding for cross-chain asset transfers among DeFi participants. With a growth rate of 425%, it surpassed Serum in August and ranked second. Based on the current growth rate, it will become a strong competitor of Raydium.  Changes in TVL’s top ten DEX platforms in different public chains, data source: Footprint Analytics (6) Solana’s Raydium has ranked among the top ten DEX platforms, currently ranked ninth From the TVL distribution of different platforms provided by Footprint, the top ten DEX platforms in the past were all based on the Ethereum chain. Although Ethereum’s ecological status is difficult to shake, with the rise and development of many public chains, other public chains have also performed well. Among them, Raydium, the head DEX platform of Solana, has exceeded the top ten with a TVL of US$1.1 billion. This is the only public chain on the DEX track after Ethereum, Binance Smart Chain and Polygon. As for the future, it is worth looking forward to whether Saber, the DEX platform with the fastest development speed in the Solana chain, can also occupy a position. Summarize The Solana public chain, driven by capital support and a large amount of technology research and development, finally exploded after the ecosystem became more complete. We analyzed and presented the Solana public chain data collected by the Footprint platform from multiple angles. We will continue to cooperate in tracking the development of popular ecosystems such as Solana. Readers are welcome to continue to pay attention. -END- Blockchain Research Club The Blockchain Learning Club is a blockchain knowledge learning and investment research platform that attempts to present difficult knowledge in various fields of blockchain to everyone in the form of popular science courses, providing a platform for blockchain enthusiasts and investors to enhance their knowledge. Founded in January 2017, we have 100,000 community users and 30 global branches. We have delivered more than 100 blockchain science courses and written more than 1 million words of popular science articles.     Revealing the secrets of Dfinity | Comparison of mainstream Rollup solutions | Polkadot slot auction Latest progress of ETH2.0 | Polkadot’s 9 most popular DeFi IDO mode explanation | Solana ecosystem overview | SNX Layer2 migration Polkadot DeFi Ecological Progress | NFT Quick Start | DeFi+Layer2 Understand the Terra ecology | Massive assets are introduced into Polkadot | DeFi+NFT Polkadot Project Overview | BSC Getting Started Guide | Rollup Splits Ecology NFT and Storage | DeFi Index Overview | King of Unsecured Lending DAO | Polkadot Quick Start | DeFi Insurance Layer 2 Affects Composability | Stablecoin Model PK Fixed Rate Lending | Polkadot Ecosystem Financing Overview | Comprehensive understanding of SNX  It is said that everyone who clicked "Looking" bought a hundred times the coins! 👇 |