39461

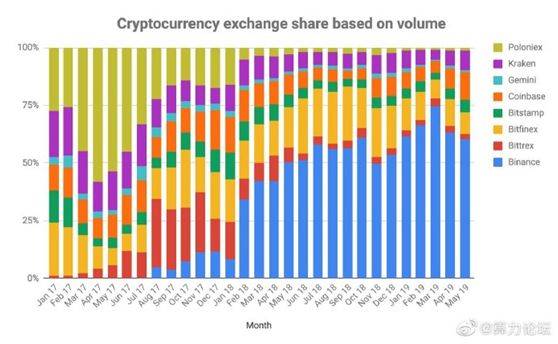

Text | The Lost Coin According to TheBlock, Binance officially announced that it will stop providing services to individual and corporate customers from the United States on Binance.com. Earlier today, Binance issued an announcement stating that it "will continue to conduct compliance checks on user accounts." In the latest "Binance Terms of Use" attached to the announcement, Binance mentioned that "Binance cannot provide services to any Americans." As of September 12, users who do not comply with Binance’s terms of use will continue to have access to their wallets and funds, but will not be able to trade or deposit on Binance.com. In response, Changpeng Zhao said on Twitter: “For long-term gains, some short-term pain is necessary. We always strive to turn every short-term pain into long-term gain. ”  When the news came out, BNB plunged 9%, 450 million in market value evaporated, and a full Dogecoin was evaporated.  But believe me, this is just the beginning of Binance’s decline. BNB’s decline is far from over, because the Sword of Damocles that has always been hanging over BNB’s head is falling. I like CZ and Binance a lot because they have fought against regulation for a long time, which seems more in line with the spirit of blockchain. But this time I liquidated all BNB, still because of their long-term resistance to regulation.  From the Alexa ranking, we can see that Binance users from the United States account for 1/4 of Binance’s total traffic, making them the largest group of users and the absolute main force on Binance. Moreover, the currency holdings and transaction scale of users in the United States are often larger than those in many countries. It is conservatively estimated that the trading volume of American users will account for more than 1/3 of Binance's total trading volume. Blocking the IPs of US users will undoubtedly cause Binance's trading volume to drop significantly, and life for BNB, which is linked to trading volume (20% profit repurchase), will certainly not be much better. If the trading volume simply declines, BNB will only fall by 1/3. But to make matters worse, among the world’s mainstream exchanges (excluding second-tier exchanges), only Binance has listed BNB. However, none of the other major exchanges in the United States list BNB. For US users who can never access Binance, liquidating and dumping BNB is the only option. If Binance’s previous statement is honest, 25% of American users, then BNB will face the largest sell-off in history. The bad news this time is comparable to the September 4th incident that targeted Binance alone. Speaking of September 4th, everyone is talking about Binance’s overseas expansion. During the September 4th Movement, many cryptocurrency exchanges were shut down, but only Binance escaped China's supervision because it had no legal currency channels. “I don’t even have a fiat currency account in Binance. How can you block me? ”——Binance thought so in 2017. Cryptocurrency has the power to provide a decentralized weapon. After Binance tasted the sweetness of fighting regulation, it began to get out of hand. Japan's regulatory policies are extremely strict. In Japan, there are no exchanges everywhere. Because all exchanges require a license issued by the Japan Financial Services Agency, and the price for obtaining this license is: 1. It is a local company; 2. Give up the right to list the currency. (Because all listings of new coins are reviewed and approved by the Financial Services Agency) ; 3. Accept extremely strict or even harsh KYC and anti-money laundering policies. Every flow of funds is carried out under the eyes of the Japan Financial Services Agency. And what does Binance rely on? Global wanderlust, altcoins and no KYC required. Thanks to the airtight protection of the Financial Services Agency, it was difficult for Japanese users to buy altcoins in the past. They could only invest in mainstream currencies BTC, ETH and some compliant altcoins in Japan. However, relying on its non-compliance advantage, Binance quickly expanded its territory in Japan and was once extremely prosperous. But soon, the Japan Financial Services Agency announced that Binance was not allowed to provide services in Japan, or even launch a Japanese page. Binance was expelled from Japan.  Japan’s Financial Services Agency expels Binance from the country The forbidden fruit of non-compliance is so delicious. Binance quickly completed the overtaking and gradually became the world's top three exchanges. After becoming famous in Japan, Binance set its sights on the United States. In the United States, Binance has risen to the top by completely stepping on the corpses of compliant exchanges.  This is a statistics of mainstream exchanges in the United States, starting from 2017. We can see that Pnet, Bnet, Bitfinex, Karken and Coinbase are the most popular exchanges among Americans. Coinbase has made great concessions for compliance. For a long time, Coinbase could only trade Bitcoin, Litecoin, and Ethereum, while shutting out all other altcoins because Coinbase had to comply with the supervision of the U.S. Securities and Exchange Commission (SEC) and the U.S. Financial Industry Regulatory Authority (FINRA). Karken's situation is very similar. As for Bitfinex, although its path is very wild, because they cannot meet the regulatory conditions and policies proposed by the US government, the Bitfinex team had no choice but to withdraw from the United States in 2017 in order to comply with the New York BitLicense and the rules set by the federal government, and meet the regulatory needs of the New York State government, handing over the large US market to others. The B network and P network, which are popular among American users, may be the biggest victims of the Binance intrusion. Since the entities of B Network and P Network are both located in the United States, although they are able to trade altcoins, they are constrained by compliance. After Binance, which has no scruples about compliance, entered the United States, the market share of B Network and P Network has dropped from more than 40% to less than 5% today, completely cannibalized by Binance. The operational capabilities of P network and B network are not weak, and they are deeply popular. The only flaw is that they are compliant. Binance has once again capitalized on the beauty of non-compliance. But although supervision will be late, it will never be absent. What is coming has come, and the U.S. SEC and other departments are also eyeing Binance. As early as September 2018, well-known cryptocurrency trader 1Broker faced serious accusations from three regulatory agencies, the SEC, CFTC, and FBI, because 1Broker and its CEO Patrick Brunner sold security-based swap contracts to investors in the United States and other countries without following "discretionary investment thresholds." Comments at the time pointed out that although neither Binance nor BitMEX officially allowed U.S. investors to invest. However, both exchanges appear to have turned a blind eye to U.S. users on their platforms. Both exchanges generate significant revenue from U.S. cryptocurrency investors.  Well-known commentator BitcoinMacro Sure enough, the U.S. supervision of Binance finally arrived, and Binance was forced to announce the suspension of services to the United States. It's heroic, but believe me, this is not the end, but the starting point. Because there is another organization called FATF, and their scope and goals are larger. On June 21, the International Financial Action Task Force (FATF) will release a final guidance plan for cryptocurrency businesses, and then determine international standards for the supervision of cryptocurrency companies in July. Why is this supervision so important? Although the regulatory standards set by the FATF are not direct legislation, countries that do not comply with the regulatory standards will be blacklisted in the global economy. Therefore, once regulatory standards are released, they will have a great impact.  Of course there is no problem with compliant exchanges, but Binance is in big trouble. There is no way for big countries to accommodate Binance. Even Malta will need to consider FATF sanctions if it wants to continue to stay in the EU. After all, most countries in the world still have to abide by the international order, except for North Korea, Iran and the smaller island countries in the Pacific. Binance was helpless, so Binance followed the example of its two Asian rivals, Huobi and OK. Huobi obtained the MSB license in the United States in March 2018, and subsequently obtained MTL licenses in many states, and made compliance cuts and isolations with Huobi Global. However, although HBUS has been in operation for more than a year and has made great efforts in compliance, its trading volume is still not as good as Huobi’s main site. Not to be outdone, OKEx began its layout in 2018. It first obtained the MSB license, and then joined the SharesPost securities token network to connect to the U.S. trading market. It also issued stablecoins with the U.S. trust company PrimeTrust. However, similar to Huobi, the trading volume of OKEx Group's U.S. station has just started. But that’s the price of compliance. If compliance restrictions are removed, all trading pairs and wallets of the exchange’s local sites around the world will be connected, and it will have global 24-hour liquidity, then this exchange will get better and better – this is what Binance did in the past. But once supervision comes, the above-mentioned liquidity must be divided among various local stations according to supervision, and comply with local laws and anti-money laundering requirements. The Sword of Damocles has fallen. At this time, Binance finally cooperated with BAM Trading Services and took out the compliant exchange BinanceUS, but I am afraid it is too late. Compliance licenses require a long time and queue, and Binance has long resisted supervision. The process may be further delayed or directly rejected. Without 1-2 years, BinanceUS is just a castle in the air. Not only is this not comparable to local exchanges in the United States, it is even a full year behind its old rivals such as Huobi OK from Asia. The seemingly glamorous biancneUS is actually just a desperate end. Yes, when the legal Sword of Damocles falls, BNB’s momentum can only end. Text | The Lost Coin Special statement: ICO projects in the blockchain industry are mixed, and investment risks are extremely high; It is difficult to distinguish the authenticity of various digital currencies, so users need to invest with caution. "Chain Internal Reference" is only responsible for sharing information and does not constitute any investment advice. All investment behaviors of users have nothing to do with this site.            |