71226

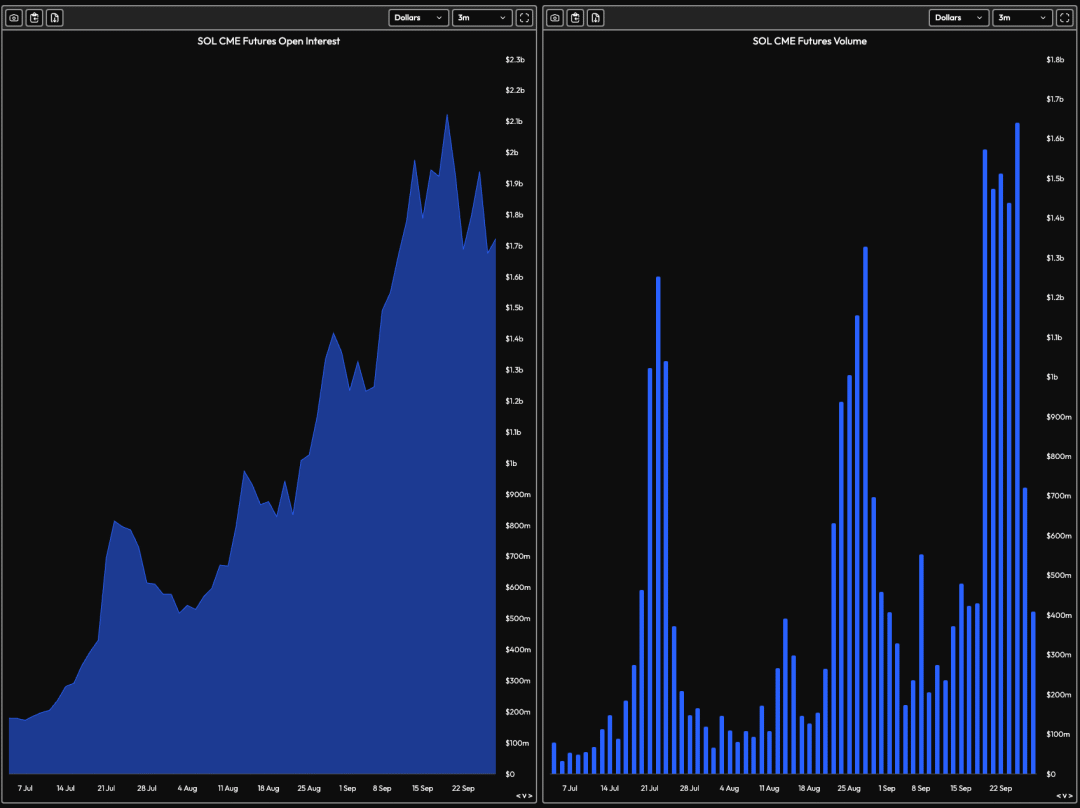

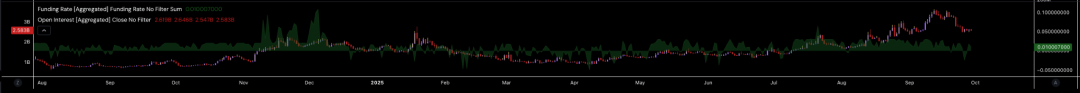

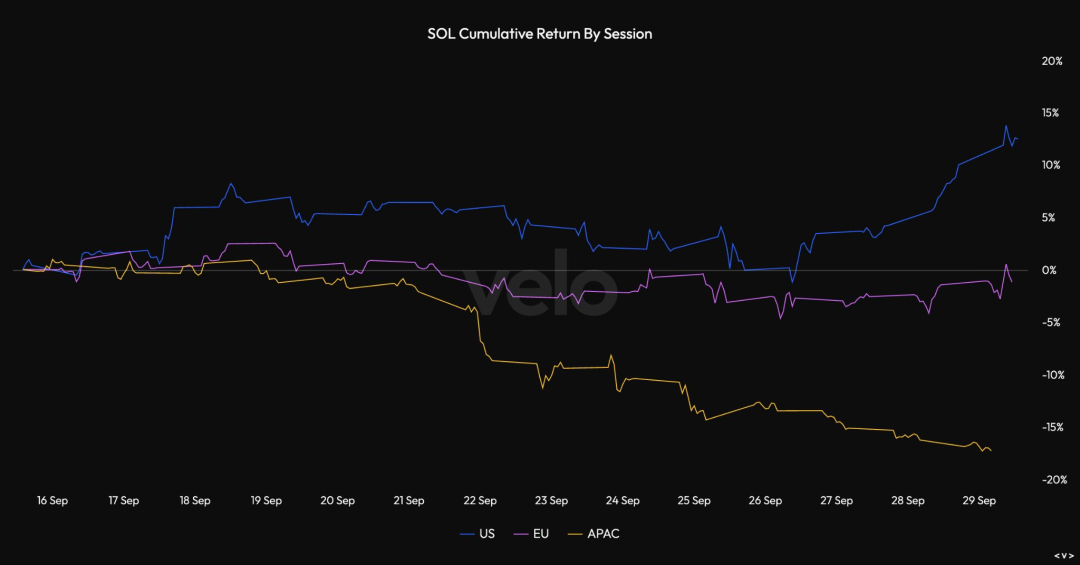

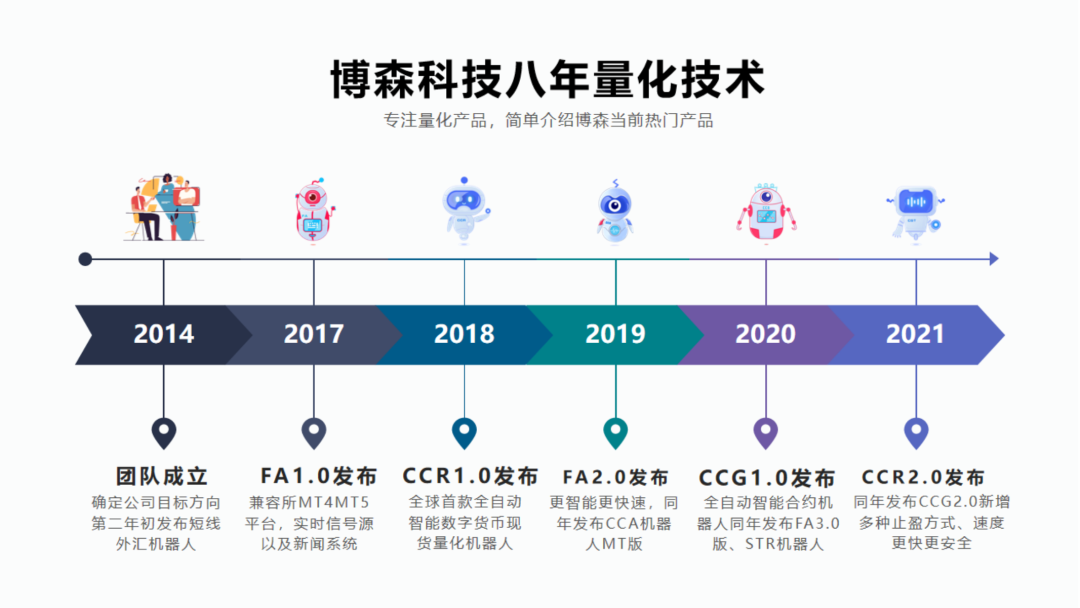

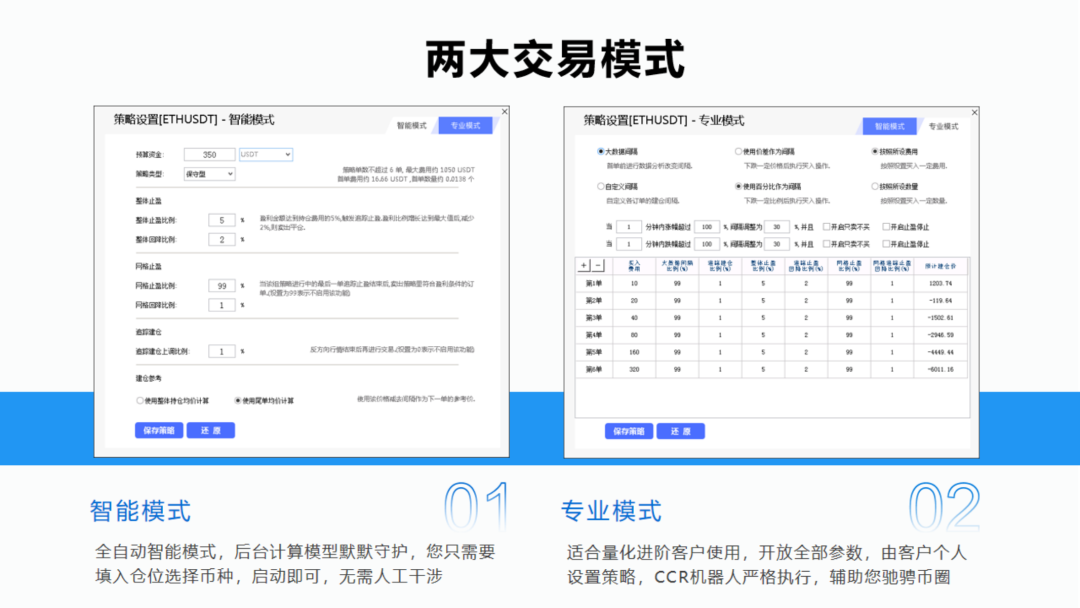

The price of SOL fell to $190 and was viewed by traders as an excellent buying opportunity. With the SEC expected to decide on the Solana ETF by October 10, SOL is poised to reach new highs.  SOL (SOL) price rose to $213 on Monday, a gain of nearly 12% in three days, indicating that the recent drop to $190.85 was viewed by traders as a bargain-hunting opportunity. As the SEC is expected to make a final decision on the Solana ETF before October 10, the SOL trend chart shows that traders intend to be the first to make arrangements, which is expected to push SOL prices to new highs in the next two weeks. The following is a brief analysis of SOL's current market dynamics. Retail long buys all pullbacksBitcoin (BTC) and the entire crypto market experienced a sell-off last Monday. According to the cumulative trading volume difference between Binance spot and contracts, Binance retail investors (position size ranging from 100 to 1,000 coins) actively bought during the decline. Spot CVD of Coinbase institutional investors (position size ranging from 10,000 to 10 million coins) also shows a similar trend.  Further evidence of retail investor demand for SOL is Hyblock’s Real Retail Long and Short Accounts indicator below, which tracks the ratio of long to short positions held by Binance retail accounts, which rose from 54.3 to 78.2 at the peak of the sell-off. As retail traders positioned themselves long, Solana's total spot order book bid-ask spread (10% order book depth) rose to 0.47, indicating that the order book was biased towards the buyer. The 4-hour cumulative trading volume difference further shows that retail investors are actively buying SOL, with trading volume reaching $71.98 million in the last 4 hours.  What conditions are needed for SOL to reach new heights?In addition to the daily price performance of the recent rebound, before the Solana ETF resolution on October 10, bullish traders betting on SOL reaching new highs need to pay attention to SOL's total open interest on centralized exchanges, as well as CME open interest and CME futures trading volume. If SOL can return to its annual high of $253 on September 18 in the next two weeks, it is expected to accumulate upward momentum. SOL's open interest in CME futures reached US$2.12 billion on September 18, and CME futures trading volume was US$1.57 billion. According to Velo.xyz data on September 26, the current items are US$1.72 billion and US$400 million respectively.  Currently, SOL total open interest is below levels seen before the yearly high. At that time, OI had climbed to US$3.65 billion.  Another metric to watch is SOL’s cumulative returns across trading sessions, especially during the U.S. session as the final resolution on spot ETFs awaits. As the chart below shows, U.S. session returns have turned positive since Friday. Ideally, if SOL becomes a highly sticky rotation trade that traders deploy before the ETF decision, the cumulative returns during the Asia-Pacific and European sessions should also increase simultaneously, consistent with the trend during the US trading session.  Official website | https://ccrcb.cc/ Hotline | 18922117055 WeChat | bosen010 Guangzhou Bolasem Technology Co., Ltd., referred to as "Bosen Technology", is one of the first high-tech innovative enterprises in China to engage in the research and development of intelligent quantitative robots. It is based on big data research on quantitative technology, combined with the implementation of automatic quantification software, to avoid the emotional and time and energy costs of manual operations. Based on the results of data analysis, the analysis team formulates quantitative models and develops intelligent quantification systems to provide professional, convenient and intelligent investment products and services to millions of investors. About us / about us    historical data / history  |