95135

|

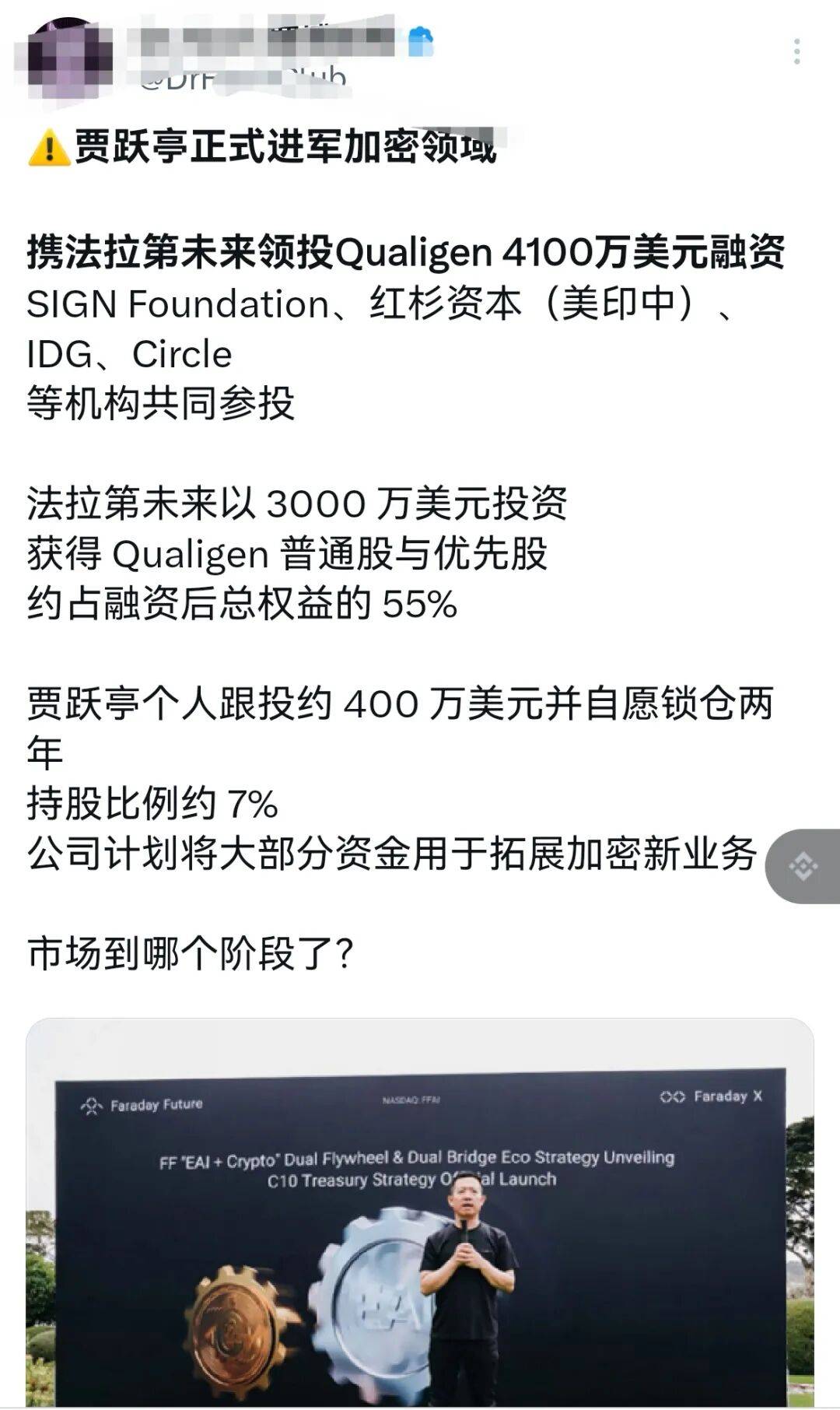

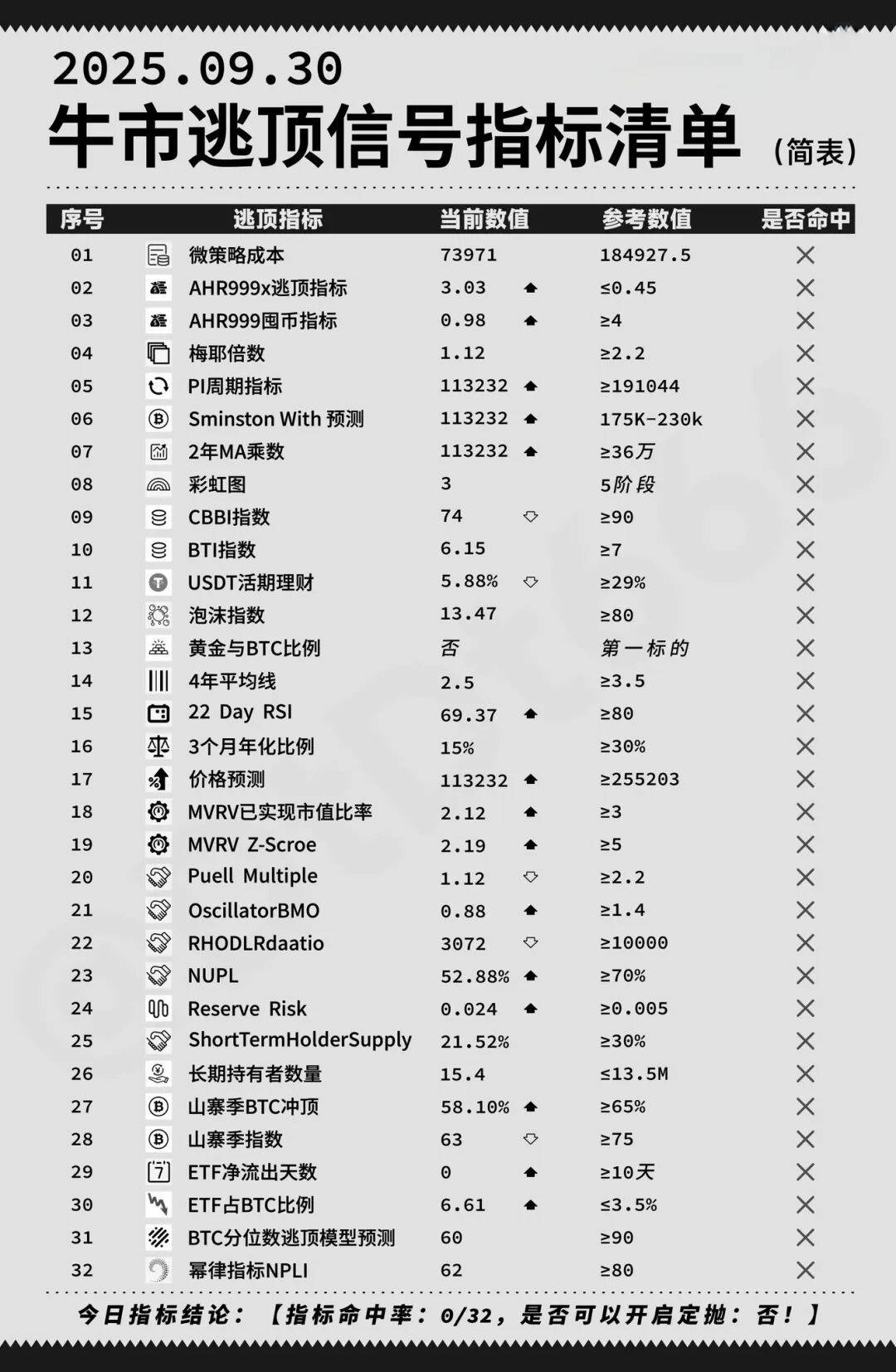

The content of the picture shows that ETH may form a "golden pit" opportunity on September 29. The three previous downward false breakthroughs were all recovered, and the first two became phased lows. If BTC stabilizes at US$113,000 and ETH stabilizes at US$4,260 this week, the signal for the end of the callback will be strengthened. In the long term, the total market value of ETH is targeted to be 50% of BTC, which means that the price will at least double. Technical charts show price action and the MACD indicator.  Another social media screenshot pointed out that when market liquidity improved slightly, Binance launched a large number of new coins, causing the "coat season" to become a "coat festival", with most altcoins underperforming ETH. The author therefore increased his position in ETH due to the support of institutional funds and was worried about the decoupling of ETH and altcoin trends. The overall content focuses on ETH opportunities and altcoin risks.  The content of the picture shows that ETH may form a "golden pit" opportunity on September 9. The three previous downward false breakthroughs were all recovered, and the first two became phased lows. If BTC stabilizes at US$113,000 and ETH stabilizes at US$4,260 this week, the signal for the end of the correction will be strengthened. In the long term, the total market value of ETH is targeted to be 50% of BTC, which means that the price will at least double. Technical charts show price action and the MACD indicator. Another social media screenshot pointed out that when market liquidity improved slightly, Binance launched a large number of new coins, causing the "coat season" to become a "coat festival", with most altcoins underperforming ETH. The author therefore increased his position in ETH due to the support of institutional funds and was worried about the decoupling of ETH and altcoin trends. The overall content focuses on ETH opportunities and altcoin risks.                  |