12885

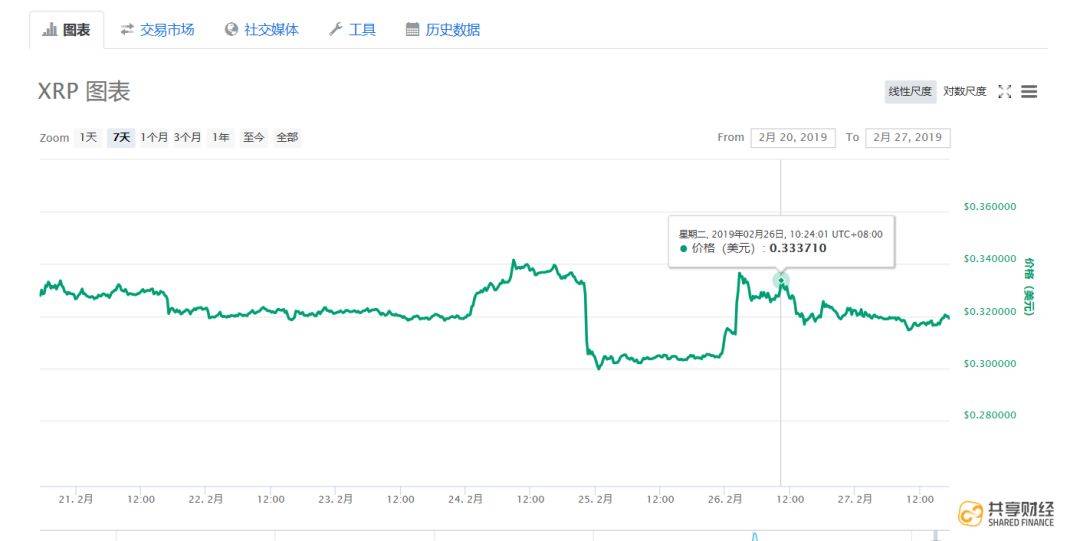

Shared Finance Media | Marketing | Consulting  Summary: Facts have once again proved that there is no business in the world that cannot be negotiated with XRP. Shared Finance reporters learned today that official news from Coinbase Pro stated that Coinbase Pro has officially opened XRP trading. Facts have once again proved that there is no business in the world that cannot be negotiated with XRP. Shared Finance reporters learned today that official news from Coinbase Pro stated that Coinbase Pro has officially opened XRP trading. Currently, XRP/USD, XRP/EUR and XRP/BTC orders are in full trading mode. Limit, market and stop orders are now all available.  The listing of the currency itself is a matter of mutual consent between the exchange and the project side. However, the "strong alliance" between the two has caused great anger and dissatisfaction in the market. Doubts and objections As we all know, Coinbase is the first cryptocurrency exchange in the United States to have a compliance license and is regarded as the benchmark for digital asset infrastructure projects. It is famous for its selective listing of digital assets and excellent compliance performance. Because of this, most people have high hopes for Coinbase. Although XRP is the third-ranked cryptocurrency, Ripple actually has absolute power over the issuance and management of XRP. Coupled with its centralization, non-anonymity, and lack of blockchain characteristics, many cryptocurrency enthusiasts and industry experts believe that XRP is not a cryptocurrency at all. Sure enough, on the day Coinbase announced the launch of XRP trading, Ethereum wallet Balance responded on Twitter, saying, "We will never support", that is, "We will never support XRP." ” More relevant analysis pointed out that Coinbase’s listing of XRP seems to violate its GDAX digital asset framework. In the filing, Coinbase stated: “The ownership stake retained by the team is a minority stake. There should be a lock-in period and a reasonable vesting schedule to ensure the team is financially incentivized to improve the network going forward. ” However, Ripple Labs goes far beyond owning a minority stake and controls more than 60%—either in escrow or directly owned by the company’s founders. Not only that, some people believe that Ripple distributes XRP by selling tokens, and most buyers buy XRP for investment purposes, so XRP should be subject to securities regulations like stocks, bonds and even most ICO tokens. As a result, listing XRP may bring serious legal consequences to Coinbase. So, what measures did XRP take to enable Coinbase to lose people's hearts, violate its true intentions, and even be willing to take legal risks? In fact, as early as April 2018, Cory Johnson, chief market strategist of Ripple, shouted to Coinbase from a distance, saying, “XRP is definitely not a security. According to the legal history of the trial, XRP does not meet the standards of a security. ” Moreover, it was previously reported that Ripple intends to provide Coinbase with zero-interest XRP loans in exchange for the opportunity to list the currency. In short, judging from the previously disclosed information, Ripple’s chosen strategy for “conquering” Coinbase is “making guarantees + sugar-coated bullets.” ” During this year-long period, we don’t know what kind of running-in the two went through in order to list the currency on Coinbase, and what kind of agreement they finally reached. However, as U.S. government law enforcement defense attorney Jake Chervinsky said, what is certain is that Coinbase believes that the benefits of listing XRP outweigh the disadvantages, including legal risks. Is there an inside story on the market? The launch of Coinbase Pro is a big plus for XRP, but judging from the current market situation, this is obviously not the case. Like Binance, Coinbase is one of the few exchanges with its own rising BUFF. Judging from past data, all currencies listed on Coinbase will experience a wave of rising prices. However, when XRP was listed on Coinbase this time, it not only rose less, but also fell quickly. Data shows that after Coinbase announced the listing of XRP, although XRP surged by nearly 10%, leading the cryptocurrency market, just one day later, XRP fell back to a 3% increase, the same as three days ago. Today, the price of XRP is $0.318, a decrease of 0.83%.  “Such a big benefit can't move XRP. In the past, it would have doubled. Now it's not even 10%. It's funny. ”Facing the XRP market, currency speculators who had high expectations were disappointed. Not only that, but today, it was also revealed that there may be an inside story behind Coinbase’s listing of XRP. According to Cryptoslate analysis reports, although within 15 minutes after Coinbase announced the listing of XRP, the price of XRP increased by about 7%, once again proving that listing on Coinbase will have a significant impact on the price of cryptocurrency. But a few hours before this announcement, XRP saw a small rebound, which may hint at insider trading. Cryptoslate further stated that compared with the price trends of BTC (2x), ETH (1.5x), and EOS (-1.5x) during the same period when it was announced that they would be listed on Coinbase, the hourly trading volume of XRP on Bitfinex increased by 6 times. Without the impetus of the news, XRP's trading volume is unlikely to see such a substantial increase, and there may be information leaks during the discussion of XRP's listing. In fact, this is not the first time people have questioned Coinbase’s listing of coins due to insider trading. As early as when Coinbase listed BCH, Coinbase was accused of insider trading. Afterwards, Coinbase conducted an internal review of its company. Although the final result is that there is no insider trading among employees, this argument is obviously not very convincing. According to the reporter’s understanding, currently, neither the XRP side nor Coinbase side has come out to clarify the matter. Why "can't pull it"” Having said so much about the stakes between the two, we return to the question that ordinary currency speculators are most concerned about: Why does XRP perform so mediocrely in the face of such great good news? In this regard, some media said that this is because the BUFF effect of Coinbase’s currency listing is weakening. Previously, the same pattern occurred when Coinbase listed Zcash. Coinbase listed Zcash on November 29, 2018, but it only rose 0.1% a day later and fell 23.4% a week later. CNN also reported that Coinbase’s trick for listing coins is not the price increase brought about by listing the currency on the exchange, but the price increase brought about by the hype of listing the currency. Those who participate in the speculation may make considerable profits from the rising and falling prices. In addition, there is a persistent voice that "XRP does not have much value in the first place." This view is that compared to other project parties, XRP is more like an attempt or a small part of the business for its developer Ripple Labs. As we all know, Ripple Labs invented the Ripple network, a blockchain protocol based on the blockchain protocol designed to replace the SWIFT protocol in bank transfers. Today, Ripple Labs has signed partnerships with more than 100 financial institutions around the world, and the future is bright. This doesn’t have much to do with XRP, though. XRP has three main purposes: (1) it can serve as a bridge currency for banks to settle international transactions; (2) it is burned to pay transaction fees; (3) it is required as a small reserve for any address using the network. Of these, only (1) will create any significant demand for XRP. However, Ripple Labs is not forcing banks to use XRP as a bridge currency, so almost none of them will do so. In fact, some sources indicate that Ripple’s xRAPID system (the only one using the XRP token) currently only has one small user and one pilot. This also means that the XRP pass must be less valuable. Because most of the value created by the Ripple network is captured through Ripple Labs stock cash flow. The value of the Ethereum token ETH is much higher because the value created by Ethereum is captured by the token. “The capital flow has been lost, and the banker will not get involved, and it depends entirely on retail investors. ”This is the current situation facing XRP. Whether it is doubts about the cooperation between XRP and Coinbase, or thinking about XRP itself, this means that there will be more voices in the decentralized world, which is a good thing. However, for those subjects with centralized attributes in the blockchain world, all ordinary people can do is stand aside and watch. Author: Shared Finance Neo Editor: Alian (This article is original from Shared Finance. Please indicate the source and author when reprinting)   [Breaking News] Bull Market Light: Nasdaq officially launches BTC and ETH indices today [Industry] Li Guoqing: I decided to set off again to pursue my dream again [Overseas] Asset management giant becomes the 229th "torch bearer"” [Industry] The sickle wielded by the encryption market is the eternal pain in the heart of Leek |