90429

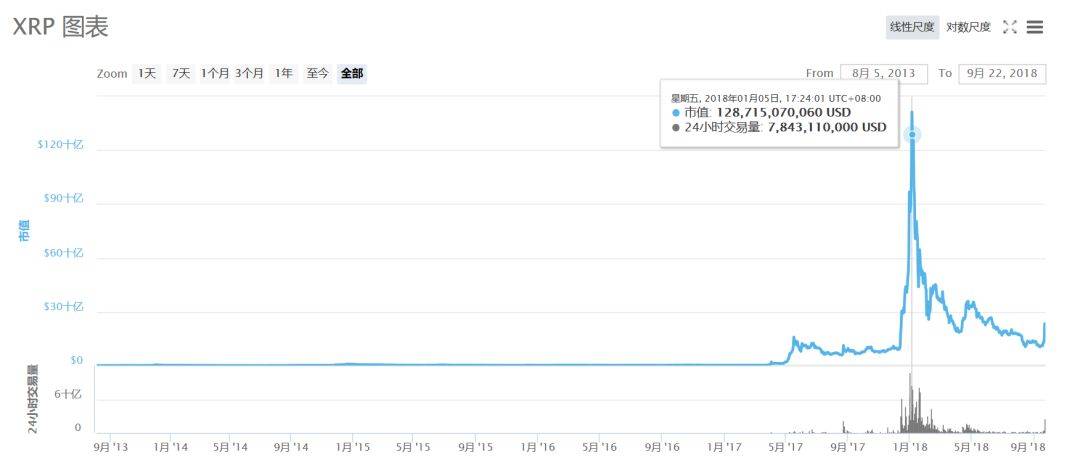

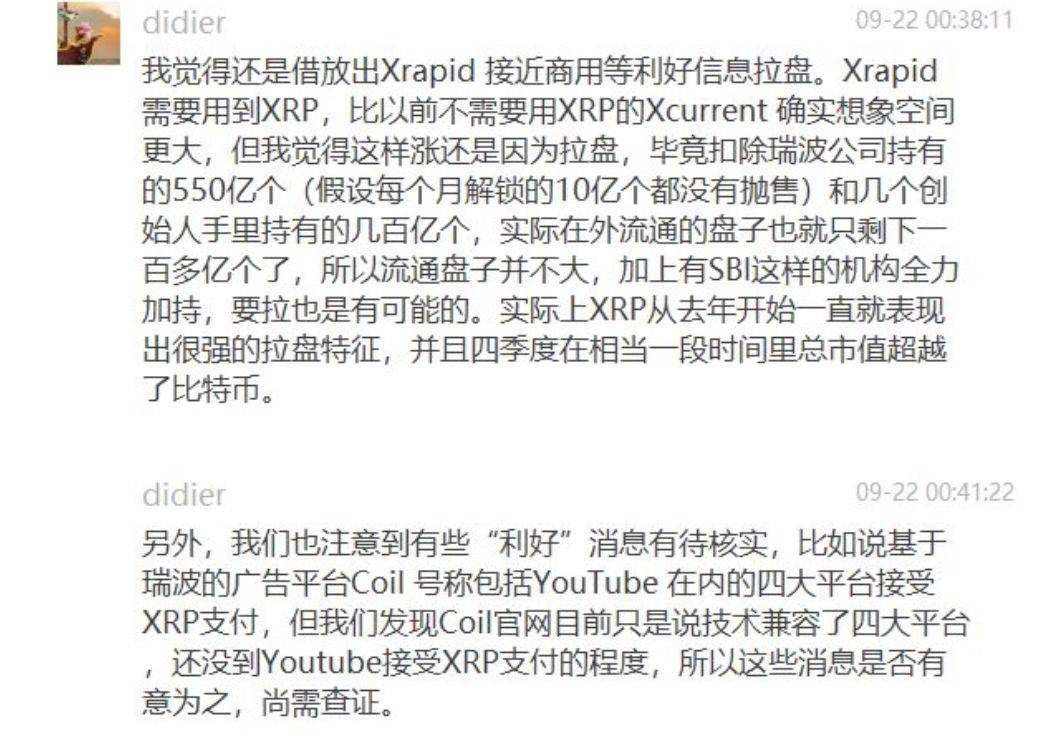

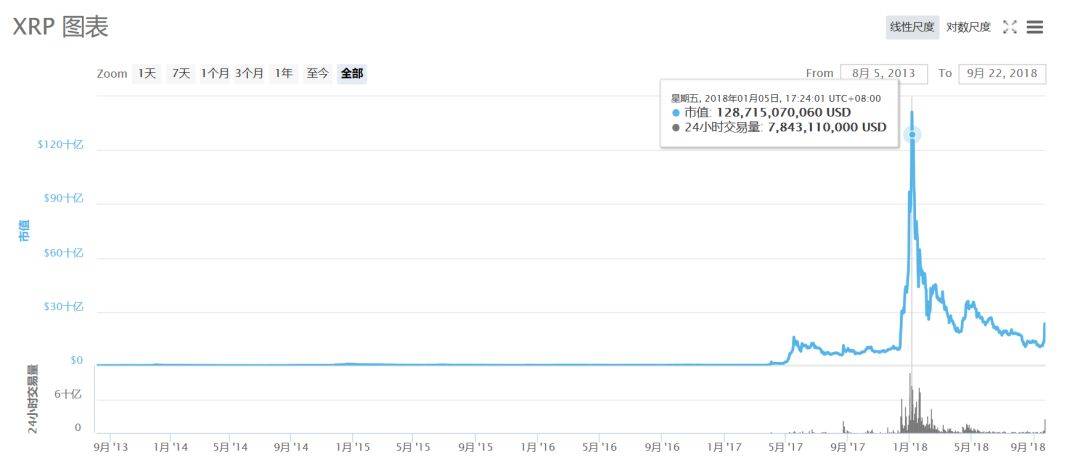

Shared Finance Media | Marketing | Consulting  Summary: “This is the first time that such a large volume has risen like this. The revelation of XRP to everyone is that the market is not short of money. ”Ripple surged last night and its market value surpassed that of Ethereum again, which made big names in the industry sigh. “This is the first time that such a large volume has risen like this. XRP has inspired everyone that the market is not short of money. ”Ripple surged last night and its market value surpassed that of Ethereum again, which made big names in the industry sigh. Soaring: Market value ranks second in the world again  Last night, Ripple’s XRP surged. According to statistics from the cryptocurrency tracking website CoinMarketCap.com, the market value of Ripple reached US$23.39 billion last night, surpassing Ethereum's market value of US$23.2 billion, occupying the second place in the world in market value for four hours. During this period, the circulating market value of XRP reached a maximum of US$30.6 billion.  As one of the top ten currencies by market value, Ripple soared 180% this week, which is unavoidably shocking in the bear market. You know, XRP, as the worst-performing cryptocurrency this year, fell more than 90% from its highs this summer. Market participants believe that Ripple’s surge this time is due to three major benefits. The earliest good news came from a report on Monday. On that day, Sagar Sarbhai, Ripple's head of Asia Pacific and Middle East regulatory relations, told CNBC that the service product xRapid has made significant progress and will be commercially available as early as "next month or so." xRapid uses XRP for settlement, which will increase the speed of cross-border transfers. Ripple CEO Brad Garlinghouse predicted in June that dozens of banks would use xRapid by the end of next year. On Wednesday, PNC, one of the top ten U.S. banking giants, announced that it would use RippleNet to process international payments for its customers. Specifically, PNC’s financial management department will use Ripple’s blockchain solution xCurrent to accelerate overseas transactions for U.S. business customers, such as immediate payments via invoices.  On Thursday, well-known video websites YouTube and Twitch announced that they would enable users to reward broadcasters with XRP. This news paved the way for the rise of Ripple. Ripple is the world's first open payment network. Through this payment network, you can transfer any currency, including US dollars, euros, RMB, Japanese yen or Bitcoin. It is simple, easy and fast. Transaction confirmation is completed within a few seconds. Transaction fees are almost zero. There are no so-called inter-bank, long-distance and cross-border payment fees. Ripple keeps most of XRP as a cryptocurrency. XRP is a company-independent cryptocurrency that can be used on Ripple’s platform. The last time Ripple’s market cap surpassed Ethereum was in January, when XRP jumped from 23 cents to $3.3. Matthew Newton, a London analyst at eToro, the world's leading social trading and investment platform, believes that whenever a mainstream digital currency skyrockets, it will make headlines and attract people's attention, which may bring incremental liquidity into the market and further boost the rise of digital currencies. Sure enough, yesterday's net inflow of XRP funds reached US$52.66 million, ranking first in the net inflow of funds. Subsequent net inflows of BTC were US$49.54 million, EOS net inflows were US$16.06 million, and ETH net inflows were US$12.28 million. In fact, some market participants pointed out that the market currently lacks confidence but not money. Before 2017, cryptocurrencies experienced rapid growth. In just five months, at the end of November 2017, the total market value of cryptocurrencies exceeded US$300 billion. The current correction is more like a repair of its own market than the bursting of a bubble. Just in early September, ICO consulting firm Satis Group released a cryptocurrency industry forecast report, which predicted that by 2028, the total market value of all virtual currency markets will reach $3.6 trillion. The report claims that more than 90% of “crypto asset value will come from the penetration of offshore deposits over the next decade,” which is expected to drive the market capitalization of all cryptocurrency markets from approximately $200 billion today to $3.57 trillion in 2028. Satis Grou also predicts that the total market value of the cryptocurrency market will reach US$509 billion next year, and estimates that the market value will exceed US$1 trillion in 2021. Question: The big rise is controlled by Lao Zhuang The long-awaited recovery in the currency market is like sunshine shining through dark clouds. But the dark clouds are still there and have not dispersed. Today, Dfund partner Li Quan poured cold water on Ripple’s surge. He said: "It's a good banker's hand. The intervals between Ripple’s several positive events are not short, and they are not that important. The sharp rise is still the result of Lao Zhuang’s control. In the long run, Ethereum, as the main carrier of smart contracts, is more important than Ripple. From a technical perspective alone, Ethereum’s community and on-chain transactions are far more active than Ripple. Currently, Ethereum is going through its tough moments, but once it gets over it, the future will still be brighter than Ripple. ” At the same time, Zheng Di, founder of Singularity Consulting, also believes that Ripple is suspected of pulling the trigger. He said that the proportion of circulating shares is small, the good news needs to be confirmed, and both R3 and Ripple have motivations to pull orders.  Some people in the industry also said that Ripple often has a "black history" of using news to pull the market, and it is difficult to give too much confidence. According to the market value trend chart of Ripple (as shown below), people inevitably have the word "air currency" popping up in their minds.  As of press time, according to statistics, the net outflow of XRP funds from 8:00 this morning to the present has reached US$5.78 million. As quickly as it came, it went as quickly as it came. Perhaps it was true to the boss’s words of “malicious pull.” Industry insiders told reporters that the authenticity of the currency circle and the mixed situation of the chain circle are all the true colors of capital exposed in the absence of effective supervision. The industry needs to develop, and supervision always comes first. Recently, Cai Liang, executive deputy director of the Blockchain Research Center of Zhejiang University and deputy dean of the School of Software of Zhejiang University, said that the biggest factor restricting the development of the blockchain industry is regulation. How to formulate regulatory standards, improve regulatory technical levels and accumulate regulatory experience are the keys to the development of the blockchain industry. Across the ocean, the United States also recognizes the importance of regulation for the steady development of the industry. Kristin Smith, director of external affairs of the Blockchain Industry Association (BA), which was led by industry giant Coinbase, recently told the media that the association looks forward to working with members of Congress and major regulatory agencies such as the U.S. Securities and Exchange Commission and CFTC to advocate flexible and sensible regulations that balance the needs of consumer protection and market integrity so that innovative companies can flourish. It is reported that the founding members of BA include Coinbase, Circle, Digital Currency Group, etc. U.S. Congressman Tom Emmer recently stated that the United States should prioritize accelerating the development of blockchain technology and create an environment in which the U.S. private sector can lead innovation and further growth. Lawmakers should embrace emerging technologies and provide a clear regulatory system so they can thrive in the United States. In any case, Ripple’s surge has brought a lively atmosphere to the encryption market. Whether it is the behind-the-scenes operation of capital or a sign of recovery in the currency market, the big guys have different opinions. As regulations become clearer, the market expects people to regain confidence. Author: Shared Finance Avalon Editor: Alian (This article is original from Shared Finance. Please indicate the source and author when reprinting)   [Breaking News] Digital Chain Rating | Strong endorsement from A-share listed companies, secondary market transactions need to be strengthened [News] BM only focuses on developing hackers and only reaches out to make money [Overseas] The first digital currency custody service is approved, and the United States is well prepared [Industry] The bubble bursts, supervision comes, and the market needs reflection |