46056

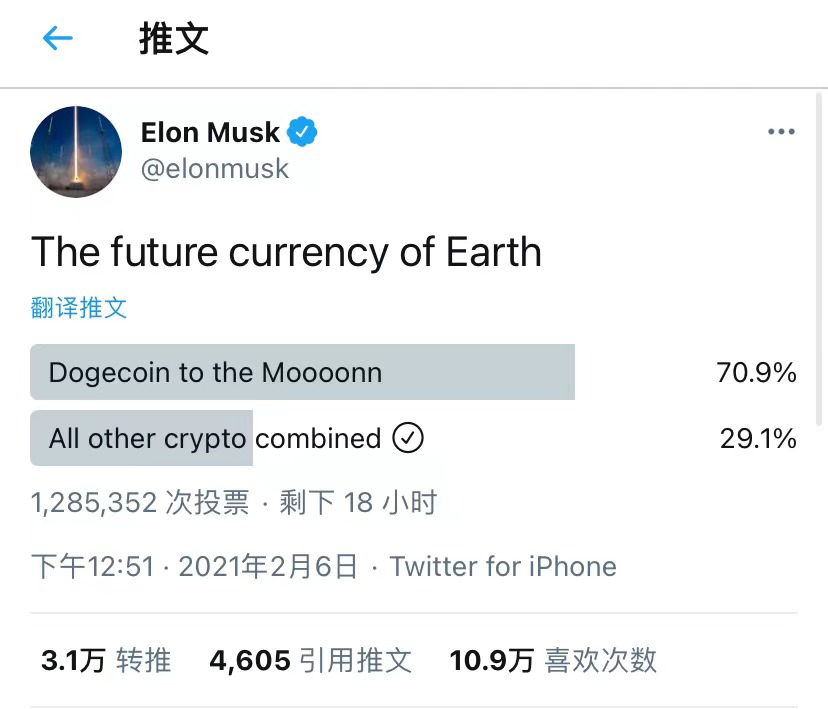

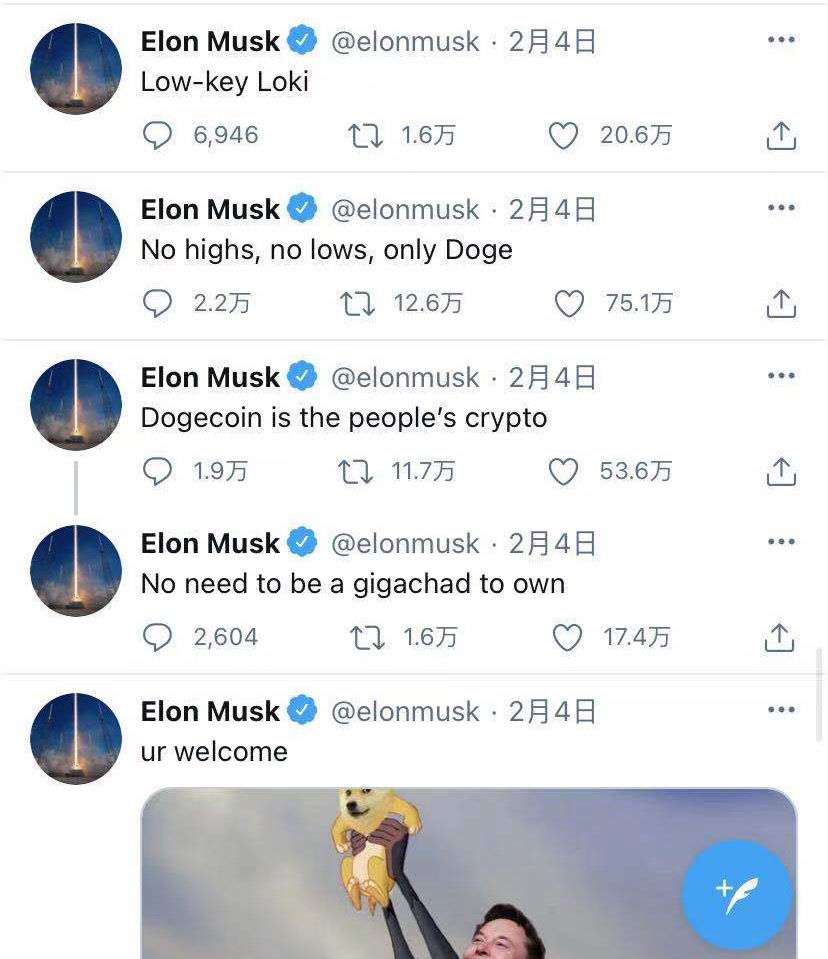

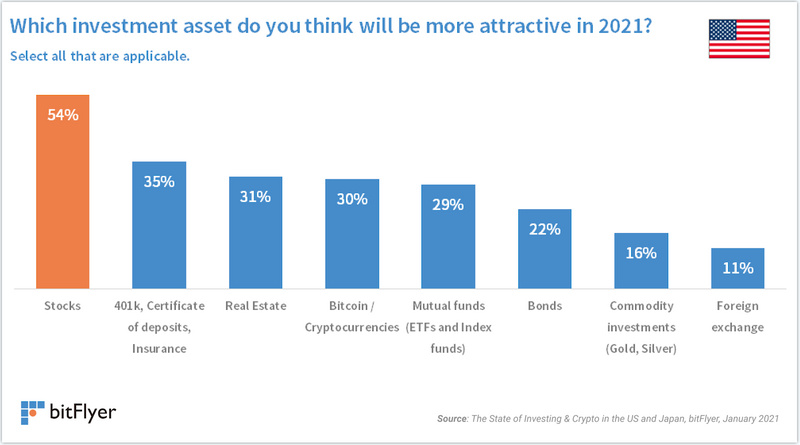

Exclusive on Tiantian Finance, follow us now Since last week, the price of Dogecoin, the originator of air coins, has skyrocketed by 500%, with the highest intraday increase reaching 1,000%. On February 6, Tesla CEO Musk launched a vote on social networks: "What do you want to use as the future currency of the earth?" As of 19:00, more than 1.28 million people had participated in the vote. Among them, 71% of netizens chose Dogecoin as the future currency, and 29% chose other currencies.  Source: Internet Subsequently, Dogecoin had a super positive line in the short term, rising by more than 8.88% during the day, and as of press time, it was US$0.049, approximately RMB 0.32 yuan.  Source: OKEx Musk takes action Dogecoin takes a roller coaster ride Recently, the short-squeezing incident by retail investors on the U.S. stock GameStop has spread to the currency circle, and the retail investors who have formed a group seem to have found a new target-Dogecoin. According to the data, Dogecoin was born in 2013. Due to its low price and community-friendliness, it has been active in the Reddit community all year round. It is very popular and its popularity even exceeds that of most mainstream currencies. OKEx market data shows that the price of Dogecoin has not exceeded US$0.01 (approximately RMB 0.064) since 2019 until recently. But seven years later, on January 28 this year, on the American retail investor community WallStreetBets (WSB), which is the main forum for public opinion in this long-short war, the “WSB Chairman” with 700,000 fans intensively posted remarks about virtual currencies and Dogecoin, instantly igniting the enthusiasm of retail investors who were already on board. Subsequently, Dogecoin started a skyrocketing mode and once topped the growth lists of major exchanges. Its market value approached US$10 billion, and it even ranked among the top ten cryptocurrencies by market value. The world's richest man and Tesla CEO Elon Musk also played a role in fueling the situation. On the afternoon of February 4, Musk tweeted in support of Dogecoin, saying, “We don’t need to be billionaires to own Dogecoin, Dogecoin is the people’s virtual currency. I didn’t drink too much, I wasn’t depressed, I only had Dogecoin in my mind. ”  Source: Internet Will it become the next Bitcoin? Under the skyrocketing market, have investors really made money? A Dogecoin investor told a reporter from the China Securities Journal: "In the bull market, just one chance to be right on one coin is enough. Dogecoin is very easy to make money when the market is good these days. I opened a few orders with a leverage of 75 times to do short-term, fast in and fast out. One order was completed in a very short period of time, earning hundreds of thousands of yuan, and the scenery was very blurry. ” But he also said: “After all, Dogecoin is not a mainstream currency such as Bitcoin, and I have no confidence in holding it for a long time. But Dogecoin’s logo is liked by many people, and it is also an old currency for many years, so it has many investors in China. ” Another investor pointed out that Musk's recent orders seem to be increasingly "ineffective" and the market is no longer excited by his casual remarks. Retail investors can easily become a tool used by market makers. Just like the last surge in Dogecoin, they first pull the market quickly, and then sell their chips when retail investors enter the market. Industry insiders said: “Dogecoin will rise after placing orders, but there will be more ups and downs in the middle. Investors who gain from the rise of Dogecoin are bound to be far smaller than those who lose due to the ups and downs of the market. ” Ma Tianyuan, chief analyst of Huobi Research Institute, pointed out to a reporter from China Securities Journal that Dogecoin is easy to purchase on non-crypto trading platforms such as Robinhood, and the unit price is very low, so the investment threshold for users is very low. Recently, mainstream virtual currencies such as Bitcoin have been fluctuating sideways, and speculative funds are also looking for new entry opportunities. Despite Dogecoin’s rapid rise this time, he still reminded investors to be cautious when entering the market: “First, the Dogecoin project itself is more like a cultural symbol. Compared with mainstream virtual currencies, there are almost no breakthroughs in technical concepts. Secondly, Dogecoin holders are highly concentrated. The top 10 holding addresses own 41.35% of all circulating tokens. It is easy for a small number of users to control the price. ” Bitcoin surges nearly $2,000 1.6 billion funds turned into "cannon fodder"” Musk’s “magic move” also sent Bitcoin to $40,000.  Source: OKEx After Dogecoin skyrocketed, Bitcoin also experienced a surge on February 6. After breaking through $38,000 on February 5, Bitcoin trading volume continued to rise. As of press time, Bitcoin has exceeded the US$40,000 mark for the first time since January 14, with a market value of US$745.1 billion, approximately 4.81 trillion yuan, nearly 2 trillion higher than Kweichow Moutai (market value of 2.9 trillion), equivalent to 4 Wuliangye.  Source: Weibo Even though the Bitcoin bull market is full of opportunities, it is also extremely dangerous. UAlCoin data shows that as of press time, in the Bitcoin contract market, 14,000 positions were liquidated across the entire network within one day, totaling approximately 1.6 billion yuan. Among them, the largest liquidated short order resulted in heavy losses, amounting to RMB 49.45 million.   Source: UAlCoin “Bitcoin has been tepid recently, with low trading volume and declining market popularity. Coupled with the previous attempts to lure bulls, I have too many reasons and excuses to short. Considering that we are in a bull market, the risk of shorting is really high, so I only conservatively opened low leverage. Fortunately, I did not lose much. ”one investor said. Xu Tong, a senior analyst at Huobi Research Institute, said: Bitcoin has emerged from a V-shaped pattern in the past month. It only took 4 days to go from 30,000 points to 40,000 points, accumulating a large amount of profits and a certain amount of selling pressure. Once selling begins, the selling pressure will prompt more sellers to take profits. At present, the selling sentiment has been fully digested. Recently, Ray Dalio, the founder of Bridgewater Associates, the world's largest hedge fund, wrote in a daily news briefing column sent to clients that Bitcoin is "an amazing invention" and that Bridgewater may consider using a new fund to invest in Bitcoin in order to preserve wealth for clients when legal currency depreciates. The 2021 Virtual Currency Report released by Bitflyer, a well-known virtual currency exchange, shows that among the investors surveyed, virtual currencies such as Bitcoin have surpassed gold and become the fourth most popular investment tool, while stocks, pension insurance and real estate are the top three that investors are most interested in.  Source: Bitflyer Editor: Zhang Nan Cao Shuai  Recommended reading ➤There are private equity funds that earn nearly 100 million per capita! No wonder so many big public fundraisers want to run private ➤Attention 58,800 shareholders! In the past, bull stocks locked 1 yuan in advance and were delisted. There was no delisting period. These stocks were also very dangerous. ➤Chen Guangming’s Ruiyuan Fund equity incentives are launched! Fu Pengbo sold 20.51% of his shares, and many company veterans subscribed ➤This year, it has been on the Dragon and Tiger list 12 times, and institutional seats have entered and exited 30 times! What happened to this company?  stamp!  |