68456

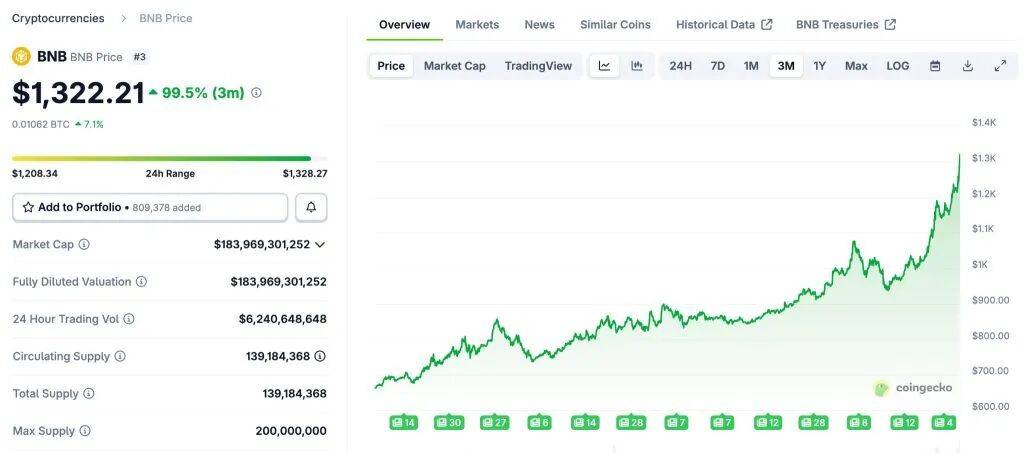

BNB price surged to over $1,300 this month, hitting its second all-time high with a 19% weekly gain, surpassing XRP to become the third-largest cryptocurrency with a market capitalization of $154 billion, BNB Chain topped the blockchain in terms of 24-hour fees.  On October 6, 2025, Binance Coin ( BNB ) price surged above $1,300, hitting its second-highest level on record within hours after breaching $1,200 earlier in the day, transcend XRP becomes the third largest cryptocurrency by market capitalization.  The 19% weekly gain puts BNB’s market capitalization at over $154 billion, Exceed Tether and XRP, second only to Bitcoin and Ethereum. BNB Chain Ranked highest among all blockchains in terms of 24-hour fees First, followed by Hyperledger and Solana. This rise coincides with Bitcoin Hits all-time high above $126,000 as The U.S. government continues to shut down prompting investors to view cryptocurrencies as safe-haven assets. Founder Changpeng Zhao emphasized the growth of the ecosystem, with 30% of BNB’s supply currently pledged as institutional funds flow in and DeFi expands. Historically, October has been a strong fourth-quarter period for cryptocurrencies, with Bitcoin gaining an average of 79.6% in the past fourth quarter. CZ admits that despite BNB price increase, he prefers X over Binance SquareIn the process of these crazy attacks on the new ATH, Changpeng Zhao admit , who personally prefers using X over Binance’s own social platform Binance Square, even though the latter has 275 million users since its launch in 2023. CZ cited safety concerns as the main reason and said he likes“ Stay logged in when not trading ”, and can go months without logging in. He noted that he uses X to reach out to the “non-Binance community” and put it at the center of the broader cryptocurrency discussion. The comments drew mixed reactions, with critics questioning why the founders weren't actively participating in their own ecosystems. This is in sharp contrast to Elon Musk's frequent posting on X since acquiring Twitter in 2022. CZ finally stated that he future“ Maybe” will switch back to Binance Square. Political uncertainty and institutional demand drive broader market gainsBitcoin price surges above $126,000 while Spot ETF inflows exceed $1 billion , including nearly $970 million in BlackRock’s iShares Bitcoin Trust Fund, with trading volume increasing by more than 20% from the previous day. Analysts attributed the rise to Bitcoin’s appeal amid April’s halving, the Trump administration’s pro-crypto policies and political uncertainty caused by the government shutdown. Just yesterday, Strategy Inc. reports , its 640,031 BTC holdings received $3.9 billion in unrealized gains in the third quarter, with a total fair value of $47.35 billion. Earlier today, VanEck's Matthew Sigel express , surveys show that compared with gold, young consumers increasingly favor Bitcoin to preserve wealth. He pointed out that about half of gold's market value comes from its store of value role. If Bitcoin occupied half of this market, then based on today's record gold price, the price of each Bitcoin would reach $644,000. VanEck predicts that by 2050, Bitcoin can settle 10% of global trade, supporting a long-term price of US$2.9 million per Bitcoin, equivalent to a market value of US$61 trillion. Technical analysis predicts $1,500 price target after pattern breakoutHourly chart analysis shows, BNB After breaking out of consolidation near $1,193, it is trading at $1,266.83 with an upside target of around $1,347, representing a gain of 6.3%.  Conversely, downside risk lies below $1,183, which would lead to a potential 6.6% downside. The consolidation range near $1,193 represents the basis for the recent rally, with a relatively balanced risk-to-reward ratio suggesting that buyers and sellers are currently in balance. Furthermore, daily chart analysis OK Three different stages of breakthrough. The first breakout was at $650, up 27%; The second breakout was based at $850, up 29% ; Forecasts suggest that a third breakout could bring a 51% rise to $1,500. However, the model of rising percentage gains assumes unlimited purchasing power and ignores the profit-taking dynamics that often occur after large increases. BNB has recently gained over 100% from a price of around $600. The $1,500 price target represents an increase of approximately 18.5% from current levels of approximately $1,266, which would require BNB to reach a market capitalization of over $208 billion and fully surpass XRP and USDT to solidify its position as the third largest digital asset. This rally didn’t start overnight; The price of BNB has increased by more than 99% in the past three months.  Some analysts believe that FOMO could push BNB towards $1,500 as the next psychological target, although ecosystem developments and Treasury buying may already be priced in current valuations. As things stand, if the momentum continues, BNB A continued push towards $1,400-$1,500 is likely, but as the market digests the recent 100%+ gains from the $600 base, BNB consolidation between $1,200-$1,350 seems more likely. If profit-taking accelerates following the break above the all-time high, a pullback to $1,100-1,150 is still possible as balanced risk parameters on the hourly chart contradict aggressive long-term forecasts. A single tree cannot make a boat, and a lonely sail cannot sail far! In the currency circle, if you don’t have a good circle and don’t have first-hand information about the currency circle, then I suggest you follow me and take you ashore. You are welcome to join the team! ! !  |