47376

Dogecoin Price Forecast: Dogecoin is trading near $0.25, with technical analysis showing a repeating 1.618 Fibonacci extension pattern, suggesting a rise to $2.28 is possible if current cycle momentum and institutional accumulation continue to support the trend.

What is the Dogecoin price prediction based on Fibonacci levels?Dogecoin price prediction uses repeating Fibonacci extensions that have occurred in past cycles; the 1.618 level marks a major historical peak, and the current structure near $0.25 suggests that if similar momentum and accumulation continues, a rise to $2.28 is possible with the 1.618 target. How do historical cycles match Fibonacci structures?The historical cycles (Period 1 and 2) reached the 1.618 Fibonacci extension before forming a new bottom. Cycle 3 shows similar higher lows, rising accumulation, and stable trading range, matching the technical footprint of the previous rally. Analyst Javon Marks observed 1.618 completions consistent across the cycle, indicating a repeatable structure. Dogecoin is trading near $0.25 as its chart repeats past Fibonacci patterns, suggesting potential growth to $2.28 amid institutional accumulation.

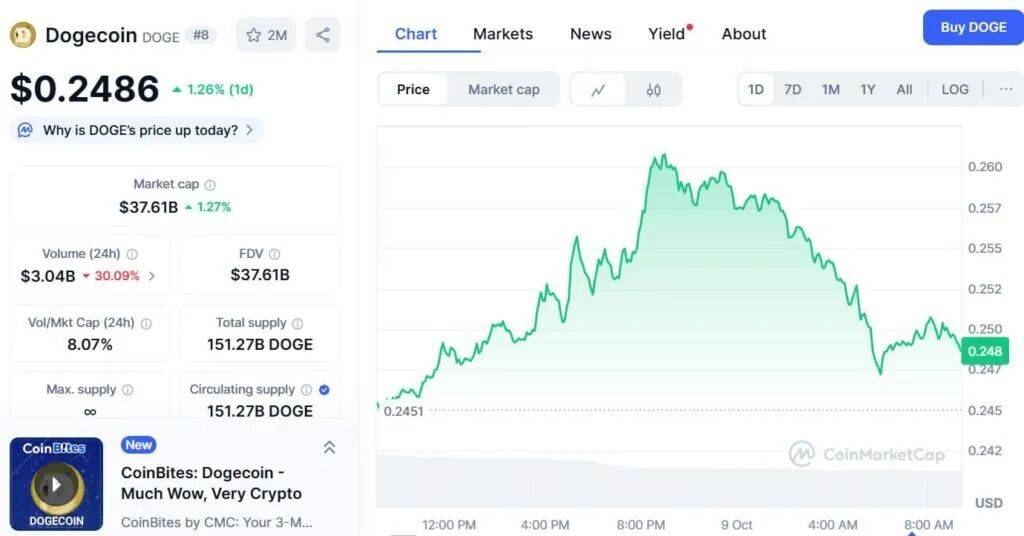

Dogecoin continues to stabilize near $0.25 as analysts observe patterns similar to previous growth cycles. The coin has been reaching the 1.618 Fibonacci level for the past two major cycles. Based on this pattern, the likelihood of repeat performance remains strong, suggesting a ~800% rise to $2.28 is possible in the current cycle. Historical cycles and Fibonacci structuresAnalyst observations indicate that Dogecoin reached the 1.618 Fibonacci extension in both previous market cycles. Each period has shown strong rallies followed by consolidation, creating recurring price action. The current cycle (Cycle 3) shows higher lows and rising accumulation consistent with the previous expansion. Historical data shows that both the first and second cycles completed Fibonacci extensions and then stabilized at a new price base. The pattern suggests that Dogecoin’s market movement follows a structured expansion consistent with Fibonacci predictions. Marks said that “the likelihood of Dogecoin reaching the 1.618 Fibonacci level again this cycle is extremely high,” citing consistent cycle performance. If this historical trend continues, Dogecoin could climb from the current $0.25 range to $2.28, a target of approximately 1.618. A stronger momentum repeat could push the price to a higher theoretical extension near $9.80, representing a larger percentage gain in the extreme case. What are the current market conditions and institutional accumulation details?Market data shows that the market value of Dogecoin is close to US$37.61 billion, and the 24-hour trading volume exceeds US$3 billion, indicating strong liquidity on the exchange. These on-market liquidity indicators support the viability of large swings as demand accelerates.  Corporate interest is increasing. CleanCore Solutions disclosed holdings of over 710 million DOGE, worth nearly $188 million, with a stated goal of growing its treasury to 1 billion tokens through a structured acquisition program with major exchange partners. CleanCore’s stated strategy is to position Dogecoin as a transaction-grade and reserve-grade digital asset. CleanCore CEO Clayton Adams said the move is in line with the group’s strategy to build long-term Treasury exposure to Dogecoin. If market conditions remain favorable and investor confidence persists, Dogecoin could rise to key Fibonacci levels cited by technical analysis. Dogecoin Price Target Comparison

FAQHow likely is it that Dogecoin will reach the 1.618 level this cycle?Past cycle performance and the current technical structure increase the odds, but the final outcome depends on liquidity, macro risk sentiment, and continued accumulation by large holders. What indicators should traders monitor?Monitor on-chain accumulation, exchange liquidity, volume, and price structure relative to Fibonacci extensions. Confirmation of rising volumes at key resistance levels reinforces this scenario. Does institutional accumulation warrant price targets?No. Institutional accumulation improves odds by reducing supply and increasing demand, but price action still needs to match market liquidity and broader market sentiment. Key takeaways

in conclusionDogecoin remains close to $0.25, while technical and on-chain signals suggest a possible move towards the 1.618 Fibonacci target of $2.28. Institutional accumulation, liquidity, and cyclical structure increase probabilities but do not guarantee outcomes. Monitor volume and accumulation for confirmations and review exposures as market conditions change. Sesame fee anti-70% strategy +v  |