60541

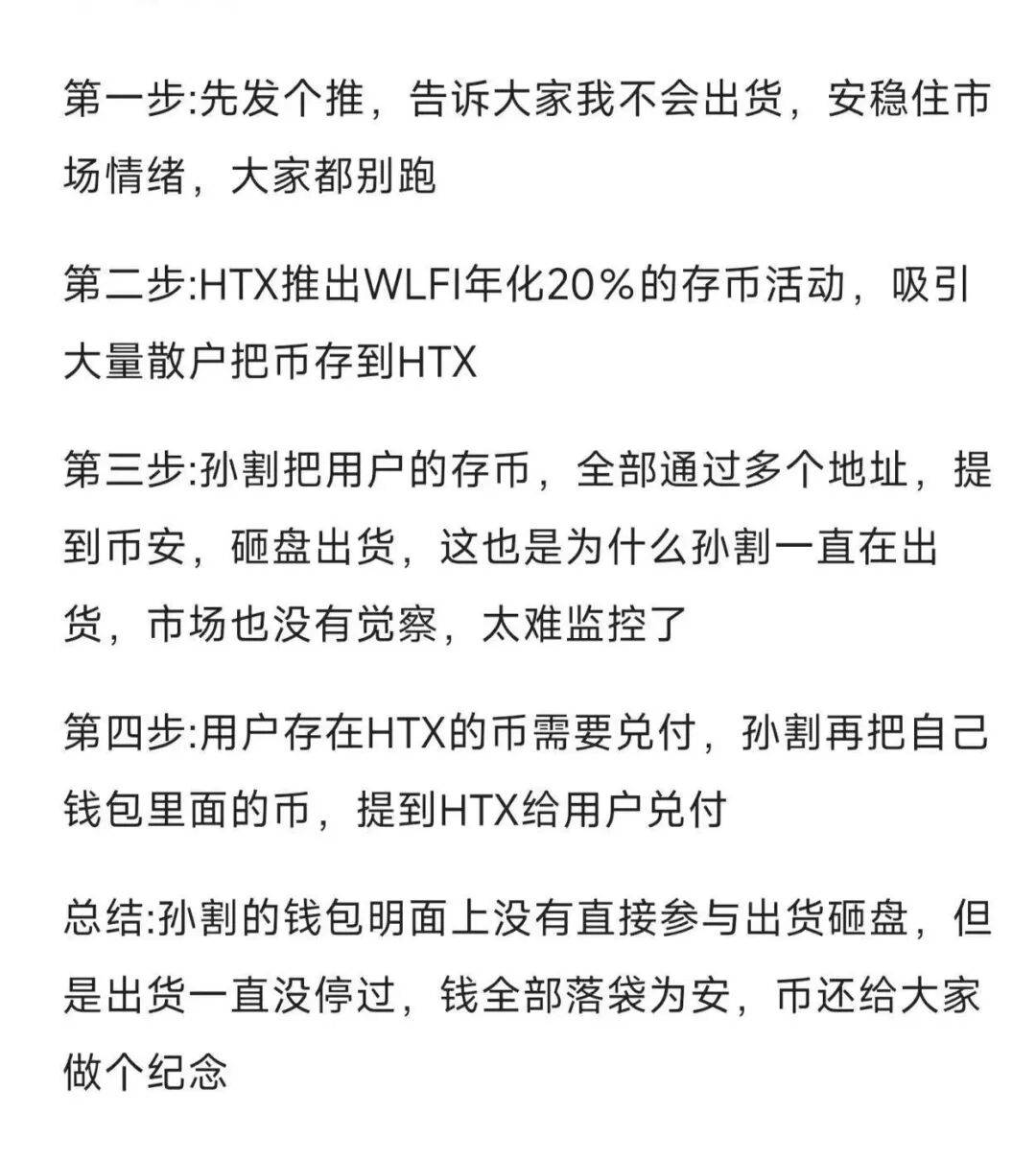

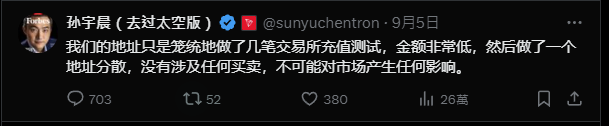

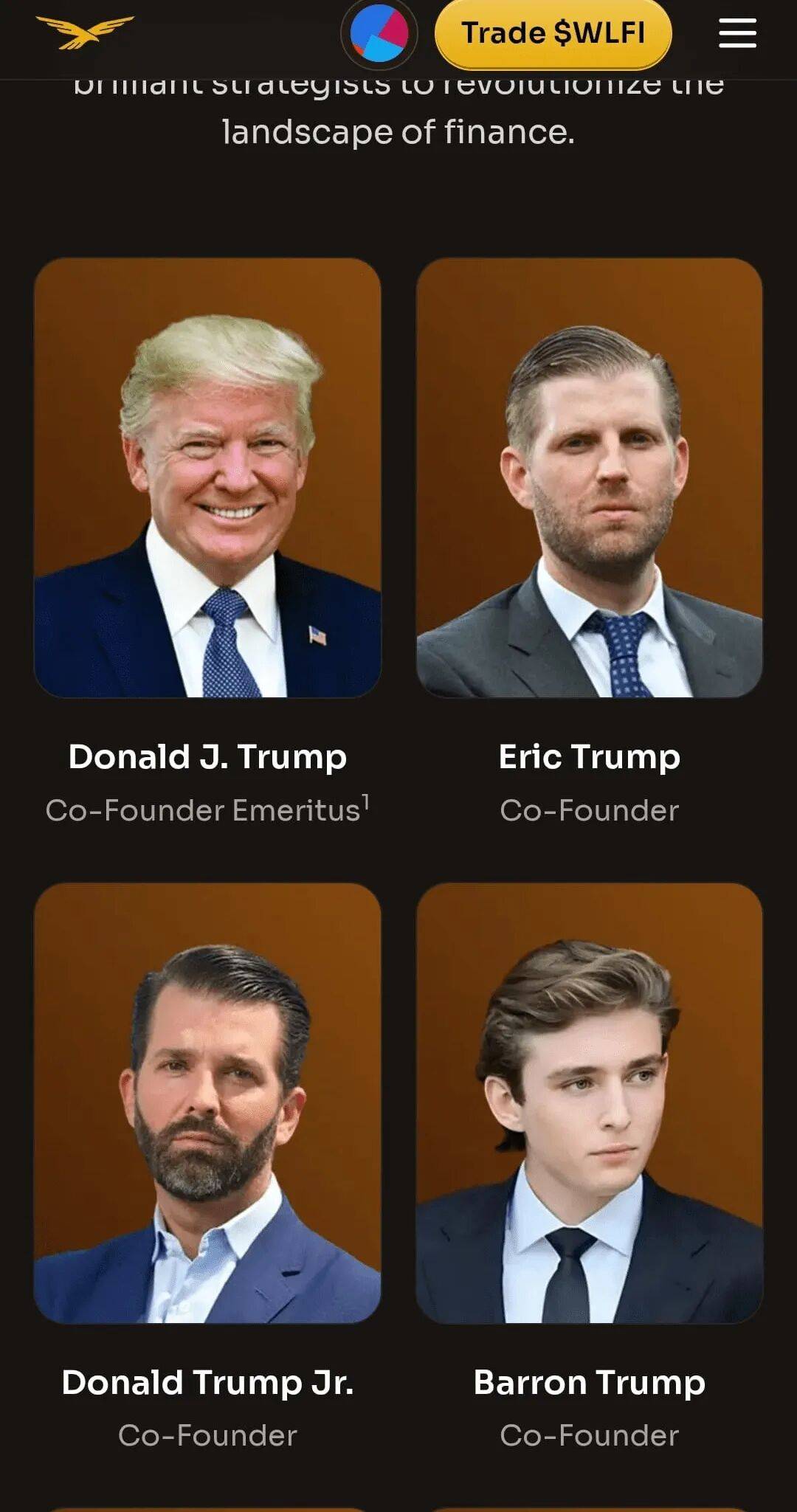

The latest breaking news! The encryption field is once again making waves. World Liberty has blatantly blacklisted Justin Sun's address. Not only that, it has also directly locked up to 540 million unlocked tokens and 2.4 billion locked tokens. They declared to the outside world that they firmly believe that there is an exchange that has long used users' tokens to conduct malicious sales, thereby achieving the undesirable purpose of suppressing prices. WLFI, this encryption project with the aura of "Trump Family Platform", plummeted from US$0.46 to US$0.18 in just 4 days after its launch, and its market value evaporated by more than US$6 billion. Behind this farce is the triple harvesting routine of the project side "destroying the promise and turning it into a numbers game", dumping the blame on Justin Sun, and turning the community vote into a "Ponzi scheme". Destruction farce: Can 0.047% "mosquito blood" save the market? WLFI once made a high-profile announcement to destroy 47 million tokens in an attempt to boost currency prices. However, this action is only a drop in the bucket for the total supply of 100 billion coins, and it is not even a "psychological placebo". What’s even more ironic is that the destruction process is opaque and there is no on-chain certificate. Investors can only passively accept the “official statement”. At the same time, the 20 billion tokens unlocked on September 1 flooded into the market, directly smashing the currency price. The destruction of the promise ended up being a "mosquito blood" farce directed and performed by the project party. Self-acting drama: Sun Yuchen "lies in the gun" and becomes the scapegoat? After the currency price plummeted, rumors suddenly spread in the market that "Sun Yuchen's selling caused the crash." However, on-chain data shows that the largest sell order came from an anonymous address and has nothing to do with Justin Sun. This move by the project side is intended to divert conflicts, shift the responsibility for the collapse to "external investors", and cover up the essential problems of concentrated token distribution and huge unlocking pressure. Or do you mean to stage a big show with Brother Sun, a self-directed and self-acted show?  Voting Trap: Community Governance Becomes a “Ponzi Cash Machine”” WLFI claims that the remaining 80% of tokens will be unlocked by community voting, and the treasury tokens will not be sold. However, voting rights are highly concentrated and controlled by early investors, and the use of treasury funds is even more mysterious. Data shows that after unlocking, the vault recharged 50 million USD1 to Binance for unknown purposes. Once the community vote gets out of control, the vicious cycle of unlocking and selling will completely destroy the currency price. The so-called "community governance" is nothing more than a "Ponzi cash machine" set up by the project team to delay the collapse and continue to harvest retail investors. Data on the chain is abnormal, and transfer behavior raises questions The outbreak of this blacklist crisis was not without warning. The trigger was a series of abnormal situations in the data on the chain. Arkham Exchange, a data monitoring agency for the cryptocurrency market, keenly captured that Justin Sun recently had a WLFI asset transfer operation worth up to US$9 million, and these assets were transferred to another address. Onchain Lens, another platform focusing on blockchain data analysis, also broke the news that in just the past two days, Sun Yuchen deposited an astonishing number of WLFI tokens to the HTX exchange, more than 5.28 million, which was worth approximately US$1.19 million based on the market price at the time. Such frequent and large-amount transfer operations are particularly eye-catching in a field that focuses on capital flow and transparency, such as cryptocurrency, and naturally arouse high vigilance and suspicion among project parties. Faced with the doubts from the project side and the atmosphere of suspicion permeating the market, Justin Sun responded quickly. He issued a statement on his usual social platform, firmly denying all the accusations against him. Justin Sun explained that these so-called large-amount transfers were actually just for exchange recharge testing, and the amount of each test was very small. In order to further reduce the possible impact on the market, they also deliberately adopted an address dispersion strategy, spreading the recharge operations to multiple different addresses. Justin Sun emphasized that the entire process did not involve any actual buying and selling transactions and would never have any substantial impact on the market price of WLFI.  However, it is still unclear whether Sun's explanation can calm the market's doubts. After all, in the cryptocurrency market, an environment full of fraud and manipulation, there may be an unknown truth hidden behind every seemingly reasonable explanation. Investors and market participants have long been accustomed to maintaining a cautious and skeptical attitude, and will not easily believe one-sided words from any party. Amazing holdings, Justin Sun was once a WLFI tycoon In fact, Justin Sun’s position in the WLFI project has always attracted much attention, and the number of tokens he holds is staggering. According to data provided by Arkham Intelligence, Justin Sun actually controls approximately 595 million WLFI tokens. If calculated based on current market capitalization, the total value of these tokens is as high as $107 million. This number fully demonstrates Sun’s important position in the WLFI project. He is undoubtedly one of the largest token holders of the project. Looking back on Justin Sun's position history, his early investment behavior can be called a "gamble." He spent a huge sum of US$75 million to purchase 3 billion WLFI tokens at one time, which caused an uproar in the market at the time. As time went by, the project unlocked tokens according to the established plan, and Justin Sun successfully obtained an additional 600 million tokens. These huge token holdings give him a decisive voice in the WLFI project and make him a key figure in the eyes of the project team and other investors. Not only that, Onchain Lens further revealed a surprising news: Justin Sun has recently made a new move. He transferred 50 million WLFI tokens (valued at about $9.12 million at the current market price) to a brand new wallet address. Judging from past experience and market practice, transferring a large number of tokens to a new wallet is most likely to deposit these tokens into the HTX exchange for subsequent trading operations. This news undoubtedly once again intensified the market's concerns about the tense relationship between Justin Sun and the WLFI project, and also made people full of uncertainty about future market trends. The “illusion” of decentralization? The power of the project party is amazing It is worth noting that the WLFI project has always claimed that it is a completely decentralized project, emphasizing its fairness, justice, and transparency in an attempt to establish an ideal image of a cryptocurrency project in the minds of investors. However, the blacklisting of Sun Yuchen’s wallet address ruthlessly burst this seemingly beautiful “decentralization” bubble and exposed the huge power hidden behind the project team to the public eye. In a truly decentralized project, the project party should only play the role of rule maker and maintainer, and should not have such a powerful power to decide the fate of investors' assets at will. But the reality is that the WLFI project can easily blacklist the wallet addresses of industry leaders like Sun Yuchen and freeze the huge amounts of tokens they hold. This behavior not only seriously violates the core concept of decentralization, but also deeply shakes people's trust system in the entire cryptocurrency industry. This incident makes people reflect on whether absolute decentralization really exists in the seemingly free and open world of cryptocurrency? Or is the so-called decentralization just a gorgeous coat, covering up the truth behind the fact that a few people control power and manipulate the market? Price roller coaster, investors’ mentality is affected As soon as the blacklist news was announced, WLFI’s price trend instantly became as thrilling as a roller coaster ride. At first, some investors in the market believed that the project party’s blocking of Sun Yuchen’s wallet address may mean that a potential source of huge selling pressure has been eliminated, which is major good news for the price of WLFI. Driven by this optimism, the price of WLFI rose rapidly in a short period of time, with an increase of nearly 10% at one point. However, market trends are often dramatic. As more details about the incident are revealed and market sentiment gradually calms down, investors are beginning to realize that there may be more complex issues and risks hidden behind this incident. As panic spread, the price of WLFI quickly reversed, turned downward, and plummeted. As of the close of the day, the price of WLFI fell by more than 16%, causing the wealth of many investors to shrink significantly in an instant. This violent price fluctuation not only caused investors to suffer serious losses in their assets, but also had a huge impact on their investment mentality. In the cryptocurrency market, a field full of uncertainty, investors are already under tremendous psychological pressure, and the roller coaster trend of WLFI prices has undoubtedly brought their anxiety and uneasiness to the peak. Many investors have begun to re-examine their investment decisions and are full of confusion and confusion about the future of the cryptocurrency market. An elaborate "cutting leeks" drama? As the incident continued to ferment, Sun Yuchen's questioned operating methods gradually emerged. The whole process was like a carefully designed "cutting leeks" drama, which was staggering. First of all, Justin Sun used his influence in the currency circle and the communication power of social platforms to make a promise to investors that he would “not ship”. This promise is like a reassurance, allowing many investors who originally had doubts about market trends to let down their guard and choose to continue to hold the WLFI tokens in their hands. After stabilizing the market sentiment, Justin Sun's HTX exchange immediately launched a very attractive currency deposit activity - WLFI with an annualized return of up to 20%. In the cryptocurrency market, such a high rate of return is undoubtedly very attractive, attracting a large number of retail investors to deposit their tokens into the HTX platform, hoping to obtain generous returns.  However, while retail investors were depositing tokens into exchanges for high returns, Justin Sun secretly carried out a series of unknown operations. Through multiple seemingly independent and unrelated addresses, he transferred the tokens deposited by users to the exchange in batches and dispersedly to other well-known exchanges such as Binance, and sold them on these platforms. This kind of operation method is extremely concealed, and ordinary investors cannot discover the source of selling pressure through conventional market monitoring methods. By the time investors discovered the abnormal decline in market prices, it was already too late, and their assets had already been unknowingly harvested by Justin Sun and others. WLFI and the Trump family: Inextricably linked The reason why the WLFI project has attracted much attention in the cryptocurrency market is that, in addition to its own development history and market performance, there is also a crucial factor, which is its inextricable connection with the Trump family. Public information shows that the Trump family, through its subsidiary DT Marks DEFI LLC, holds an astonishing number of WLFI tokens, totaling up to 22.5 billion. Trump himself directly holds 15.75 billion WLFI tokens. Based on current market prices, the value of these tokens is approximately US$6 billion. Such a huge amount of token holdings makes the Trump family play an important role in the WLFI project and has become a powerful force that cannot be ignored in the development of the project. In addition, Alt5 Sigma also spent a huge amount of US$1.5 billion to purchase WLFI tokens. Behind this transaction, there is an even more shocking fact hidden: 75% of the net sales proceeds generated by Alt5 Sigma's purchase of WLFI tokens actually flowed directly into the pockets of the Trump family. This data fully demonstrates the close economic interests between the Trump family and the WLFI project, and also raises more questions and concerns about the project’s funding flow and operating model. The Trump family’s deep involvement in the WLFI project is not only reflected in token holdings and economic interests, but also in the promotion and operation of the project. Trump has posted many times on his social media platforms, publicly promoting the WLFI project, promoting his platform, and claiming to be the "chief cryptocurrency advocate" of the WLFI project. Trump's two eldest sons, Donald Jr. and Eric, also serve as "Web3 Ambassadors" for World Liberty Financial (the operating company of the WLFI project) and actively participate in various promotional activities of the project. This all-round participation of the Trump family has undoubtedly won the WLFI project a high level of attention and topicality in the market, but it has also raised questions about whether there is political interference and benefit transfer in the project.  The aftermath of the unlocking incident has not yet been resolved, and the blacklist crisis has worsened. Before the blacklist incident broke out, the WLFI token unlocking incident had already attracted widespread attention in the market. According to the project's established plan, WLFI ushered in its first token unlock on September 1, which released 20% of the total pre-sale tokens for early investors. For cryptocurrency projects, token unlocking is often a critical time point, because it means that a large number of originally locked tokens will enter the market circulation, which may have a significant impact on market prices. On the eve of the unlocking of WLFI tokens, the market has been filled with various speculations and worries. Some investors worry that the large number of unlocked tokens will trigger market selling pressure and cause prices to fall. ; Other investors are full of expectations for the future development of the project, believing that the unlocked token circulation will bring more vitality and opportunities to the project. However, regardless of market expectations, the sudden outbreak of the blacklist incident will undoubtedly have a greater impact on the WLFI project, which was already full of uncertainty. It not only reduces investors’ trust in the project team to a freezing point, but may also have a profound impact on the entire “political token” track. As a representative project in the field of "political tokens", WLFI's every move has attracted market attention. Its performance in the market is not only related to the success or failure of its own project, but also affects the development trend of the entire "political token" track to a certain extent. The occurrence of this blacklist incident has cast deep doubts on the stability and sustainability of the emerging field of "political tokens." Many investors have begun to re-examine their investment strategies in this field, and some investors who originally planned to enter this field have also chosen to wait and see, waiting for further clarity on the market situation. Currently, the fierce battle between the long and short sides of WLFI is in full swing. However, no matter how strong the Trump family’s endorsement is, it cannot cover up the reality that the project’s token economics are flawed, the team’s credibility is damaged, and market sentiment is collapsing. For ordinary investors, it is recommended to stop losses immediately and stay away from this triple bubble project of "political aura + token economy + governance scam". For more details, please follow the public account: |