54175

|

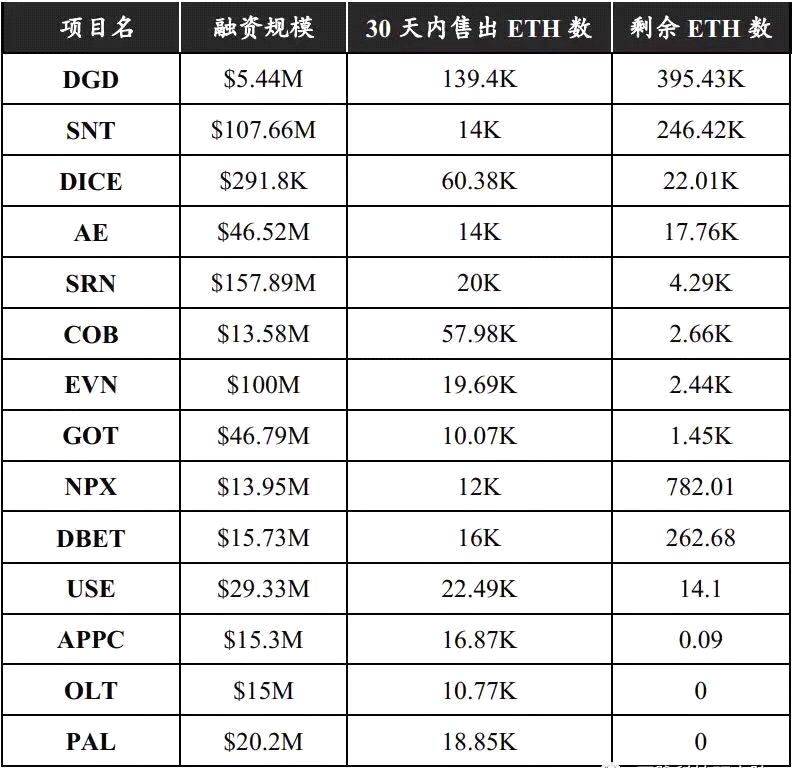

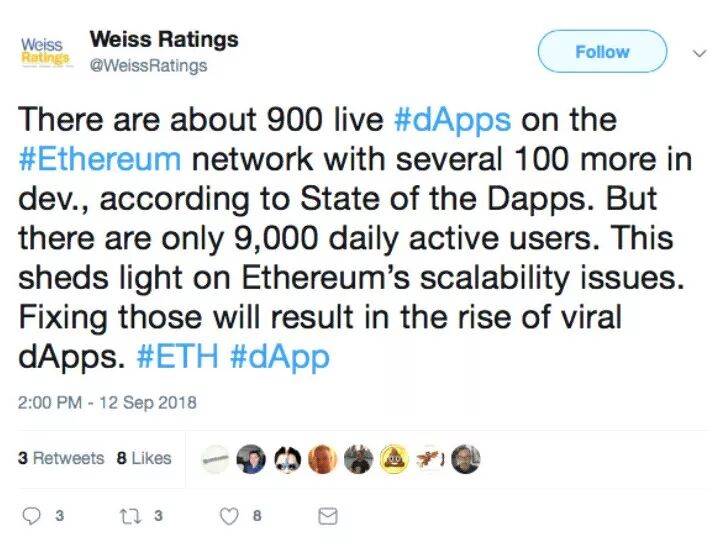

Vernacular Blockchain From beginner to proficient, just look at me! No matter how bold you are, it would be difficult for you to expect that Ethereum, which ranks second in market capitalization, first in liquidity, and first in ecology in the world of blockchain, would lose nearly 90% of its market value in this bear market. A week ago, Ethereum fell below $170, and various groups were filled with panic and despair. The slogan "Ethereum will surpass Bitcoin" that was once widely promoted in the bull market has turned into the cry of "Ether returns to zero, ETH is worthless". I heard that someone has set up a VQ group and wants to settle accounts with V God.  Only when the tide goes out do you know who has been swimming naked. The low tide this time has exposed many air coins to their ugly appearance without wearing underwear. What awaits them is the end of zero. (Returning to zero here does not mean that the price is really zero. Basically, if the price drops 99% from its highest point, we can treat it as zero. ) However, will Ethereum, the representative of Blockchain 2.0 that brings smart contracts into people's sight, also be swallowed up by the waves in this tide, giving way to the so-called public chain of the 3.0 era? Ethereum has lost nearly 90% of its market value in this bear market. Is this a precursor to Ethereum returning to zero or a prelude to its rise? Today’s article will analyze step by step the signs of Ethereum’s road to zero.; The next article will also sort out the reasons for Ethereum’s rise step by step. Contradictory? No, no, no, if you want to see the essence of things clearly, you must see both the positive and negative sides of things. As the Great Gatsby famously said: “It is the mark of first-class intelligence to hold two diametrically opposed ideas and still act normally. ” Putting aside this "first-class wisdom", today we will put different opinions here. Which one you support can be decided after reading it. 1 The first level of cognition of ether returning to zero: The project party smashed the deal The main reason for the return of ether to zero may be the failure of the project side. This is something that almost everyone knows, and it is also something that most media exaggerate. There's certainly nothing wrong with that. However, we don’t know whether the demolition is to keep the project team warm in the winter, or to keep the project team happy. Regarding smashing the market, you need to know the following two things: 1. A picture of the project team’s plan to smash the market has been widely circulated in various groups recently. It is unknown where this picture was first leaked. According to an internal staff member of a related project party, the ETH raised by the project is far less than the "financing scale" announced to the outside world.  2. We can see that many project parties remained motionless with the raised ETH when Ether was at a high level.; Now when Ether is at a low level, people are selling in a panic, fearing that if they don't sell ETH, its price will fall to the price of cabbage or even zero. These project parties have entered a typical "prisoner's dilemma". From this perspective, these project developers who "chased the rise and killed the fall" are actually quite amateurs. In comparison, the practices of the following two types of project teams are more admirable. One is to immediately convert ETH into US dollars after financing is completed for project development. ; The other type is that the team has no shortage of money for the time being, and the ETH is basically untouched. Currently, many domestic projects raise thousands or tens of thousands of ETH, and then use the raised ETH to invest in other projects. This makes people wonder, what are their motivations and purposes for financing? 2 The second-order cognition of ether returning to zero: The collapse of ETH financial consensus As we all know, ETH and BTC are not the same. BTC was first invented and used as a "peer-to-peer electronic cash system" and is called Currency Token. ETH is different. It is essentially a Utility Token. It is the Gas (fuel) on the Ethereum network, driving the operation of DApps on the entire network. (Note: Classification methods such as monetary Token and functional Token are informal classification methods. The only more formal classification method is the SEC's classification method, namely security Token and non-security Token. ) As we all know, this wave of increase in the price of Ethereum is due to the popularity of ICO. But the problem is that for project parties, especially those who are interested in it, there is not much difference between receiving BTC and receiving ETH. Just because you usually have to send an ERC20 Token first, then just accept ETH along the way. In this way, the price of ETH has been soaring. This is purely driven by the supply and demand relationship of fundraising rather than application supply and demand (Gas). It does not reflect the value of a Utility Token at all. Instead, it has reached a short-term financial consensus that everyone accepts ETH as settlement. The previous price stability or increase of ETH was not because it stored value, but because consensus became the temporary carrier of its value circulation. However, Weiss’ official Twitter recently stated that the number of DApps on the Ethereum network is 900, but the number of daily active users is only 9,000. This shows the declining acceptance of Ethereum.  Therefore, the plummeting price of Ethereum also stems from the collapse of ETH's financial consensus. 3 The third level of cognition of ether returning to zero: ETH is not a necessity for the Ethereum network Vernacular’s previous article: Buterin’s prediction will become a reality, and the wave of application blockchain projects will be reset soon? I once said this point of view: 90% of DApps cannot self-certify well, that is, why do they need to issue coins separately, and why can’t they use ETH directly? Take a look at the two most popular DApps, CryptoKitties and Fomo3D. Neither of them issues coins. They both use ETH to play directly. However, another embarrassing thing happened. Ethereum itself has to prove itself. That is, why does it need ETH as Gas? Why can’t it use DApp’s Token directly as Gas? Recently, Jeremy Rubin, one of the core developers of Bitcoin and technical advisor to Stellar, published an article expressing his opinion that Ethereum, as a platform, will eventually succeed.; As a Token, ETH will eventually return to zero. What’s even more heartbreaking is that V God “partially agreed with his point of view.” Jeremy Rubin’s core point is as follows:

In a nutshell, ETH itself is not a necessity for the Ethereum network. The core of V God’s response is as follows: He agrees with some of Jeremy Rubin’s views. It is admitted that ETH has indeed caused selling pressure on ERC tokens at present, and if ETH stops developing, then the ETH dilemma described by Jeremy Rubin does exist. However, he also said these dilemmas can be solved. 4 The fourth level of cognition of ether returning to zero: What is the market value of ETH? Readers who are interested in economics must be familiar with the famous Fisher equation. Fisher's equation is the mathematical form of the quantity theory of money, that is, MV=PQ. Among them, M is the quantity of money, V is the velocity of money circulation, P is the price level, and Q is the total amount of commodities traded. This equation shows that when V and Q are relatively stable, the currency circulation volume M determines the price P. After understanding Fisher's equation, let's look at the calculation of the ETH valuation model in the next section. The following is an excerpt from the article "An Institutional Investor's View of Crypto Assets" published by John Pfeffer on December 24, 2017, translated by NPC Translation Agency:

Of course, the above model is just a static derivation. Many factors (such as the previously mentioned financial consensus, future off-chain expansion, and the renewed popularity of ICO, etc.) are not taken into account, but are only the result of mature state deduction based on the current Ethereum Gas design model, using past experience and existing mathematical formulas. But even so, the deduced currency price and market value results can be described as disastrous. Okay, the above is a layer-by-layer introduction to the viewpoints of "The Road to Zero Ether". I wonder if you agree or disagree after reading it? More views will be discussed in the next article "The Road to the Rise of Ether", so stay tuned. If you encounter difficulties in the process of learning blockchain, you can also come to our "White Rabbit Milk Candy" Knowledge Planet (the essence of vernacular blockchain community) for answers and help!   Related reading:   ——End—— 『Statement: This article is the independent opinion of the author and does not represent the position of Vernacular Blockchain, nor does it constitute any investment opinions or suggestions. 』  Many times, the message is more exciting than the text ↓Come and upgrade your cognition and dig some mines.↓   If you like it, please give us a like, thank you (●—●) |