It’s time for year-end review again. How many opportunities have you missed this year?  Text | Huang Xuejiao source | Odaily (ID: o-daily) cover source | IC photo Since the beginning of this year, there have been frequent good news in the financial market, and the stock market, gold, and currency markets have been rising in rotation. I wonder if you have seized one of these opportunities? If you keep missing out, you might as well listen to the opportunity of the “crypto bull market” that we are going to talk about today. There are various signs that although Bitcoin is approaching a new all-time high, this will not be the end of this market. As an investor, there are only two ways to participate: buying coins and mining. Buying coins requires timing and strategy. In comparison, mining is more like building positions in batches and unlocking them regularly, which is quite suitable for this round of slow bull market trends. Is it still a good time to mine now? How else can investors participate? We interviewed the large mining company "Maoqiu Technology" about this to help everyone avoid pitfalls and enter the market.  Why is Bitcoin’s breakthrough of 20,000 US dollars just the beginning of the crypto bull market? Since March this year, Bitcoin has risen from a low of about US$4,000, breaking through new highs in 2019 and 2018, reaching a maximum of US$19,400, approaching its historical high of US$19,783 (December 2017). The upward trend of Bitcoin has not changed, and it can be seen that it is only one step away from breaking through the all-time high.  Data comes from: CoinMarketCap, interception time: November 17. You may want to ask, can Bitcoin still rise? Don't stick a pin in it, right? Regarding this, we wrote in our previous article "The Structural Opportunity "Grayscale Bull" has arrived. Is it still too late to get on board?" 》Detailed explanation. To start with the conclusion, we believe that we are still in the early stages of the crypto bull market, which means there is still room for currency prices to rise. This can be seen in the drivers of this bull market. As "Barron's" said, "Concerns about inflation have become a standard explanation for the rise of Bitcoin." We prefer to vividly attribute the driving force of this bull market to "institutional bulls" or "grayscale bulls." We can see it directly from the disk. At the end of 2017, Bitcoin rose sharply, but the higher the price, the greater the volatility. Moreover, it stayed at a high level for a short time and could not stand at all, which can well reflect the FOMO emotion (fear of missing out).  By this year, the trend of BTC's highs in 2020 can be said to be "small steps" all the way up. As long as there is heavy selling pressure when it breaks a new high, there will be a takeover below. This makes the overall volatility of BTC's current highs much lower than in 2017, and the trend is relatively more stable. Behind this trend change is the migration of investment groups and investment concepts. In 2017, speculative retail investors brought about by ICO boosted prices, so it was easy to chase the rise and kill the fall, resulting in higher fluctuations. This time, the main buyers turned into "long-termists" called institutions, and the price rose steadily, with less selling pressure. Where do these institutions come from? Real giant whales often lurk underwater. What we can see is just a glimpse of it above the water, but we can also get a glimpse of it. Since the third quarter, institutions in the industry or traditional giants have frequently taken action to provide channels for investing in crypto assets, or directly "buy, buy, buy" themselves. It is difficult not to think that the currency price will rise. From August to September this year, Nasdaq-listed business intelligence company MicroStrategy invested approximately US$425 million in two installments and held 38,000 BTC. In early October, Square, the “American version of Alipay,” announced that it sold $1.63 billion in BTC through Cash App in the third quarter, an increase of more than 15 times from the previous quarter. From October 14th to November 4th, Grayscale Bitcoin Trust increased its holdings of BTC for the 16th consecutive working day. As of November 24, the total holdings of the Grayscale Bitcoin Trust Fund (GBTC) have reached 527,900 BTC. Based on the current price of Bitcoin of $19,200, the holdings are worth $9.7 billion. According to the report, as a compliant trust fund in the United States, Grayscale’s product purchasers are mainly institutional investors (81%), followed by qualified investors and family offices (8% each). 57% of purchasing users are from outside the United States. Why Bitcoin? For a long time, Bitcoin has been hailed as "digital gold" by many people because of its scarcity, decentralized operation, and certain innovation and revolutionary nature. Bitcoin has been unable to escape the long bear market since 2017, but even so, it has been the asset with the best return on investment. Therefore, at a time when liquidity is rampant, the story of Bitcoin’s “digital gold” has become increasingly popular.  GBTC vs gold ETF trend during the year, source: JPMorgan Therefore, we see that institutional investors are still entering in large numbers, and the possibility of BTC crashing significantly is relatively low. With huge institutional funds flowing into the limited-scale currency circle, this bull market is bound to move out of a long bull and slow bull market. Based on this judgment, both large capital and small retail investors want to take a piece of this market. Investors with different capital amounts and different investment preferences have different investment postures. Those who want simplicity and worry-free can buy coins directly, those who are safe can build positions in batches (fixed investment), and those who are economically safe can choose mining. I believe we don’t need to introduce the first two. Today we will focus on some essential knowledge for entering into mining. For example, how does Bitcoin mining work? Where does it fit into the entire cryptocurrency or blockchain industry? Is it legal and compliant in the country and convenient for participation? We might as well look down.  How should investors participate in Bitcoin’s tens-billion infrastructure industry? Mining Bitcoin is essentially a process of using computing power to violently seek mathematical solutions (technically called random numbers). In the process of miners violently cracking the random numbers, that is, it completes the process of distributed accounting through Proof of Work. We know that Bitcoin is essentially a peer-to-peer electronic payment system, and BTC is the payment symbol of this system. Then, the miners who complete distributed accounting are analogous to the role of the central bank in printing money and accounting in the traditional currency system. It can be said that without the mining industry, there would be no Bitcoin, and there would be no various chains that adopt Proof of Work type algorithms (such as Ethereum, the public chain with the second largest cryptocurrency market value). Compared with digital finance, which is an avant-garde "superstructure" but it is difficult to say that it has any definite opportunities, the mining industry at the bottom is more like the "industry" in cryptocurrency. To sum up, the mining industry is mainly divided into four major links: production and sales of mining machines, construction and investment promotion of mines (professional places to host mining machines), operation and maintenance of mining machines, and joint mining (mining pools) of mining machines. Based on the output value of mining machines alone, the mining market has reached tens of billions of yuan, which shows the huge size of this market. In the Chinese market, mining is not illegal. From October last year, the Political Bureau of the CPC Central Committee emphasized "blockchain as an important breakthrough for independent innovation in core technologies." By April this year, the National Development and Reform Commission included "blockchain" in the scope of new infrastructure, clarifying that blockchain, artificial intelligence, and cloud computing belong to the information infrastructure part of new infrastructure. The importance of blockchain to the technological revolution has been fully recognized. Although blockchain is not the same as mining, the two are closely related. Mining originates from the "consensus algorithm" used by public chains to maintain the network. The two major mining algorithms involving hardware are the PoW workload proof mechanism and the PoC storage proof mechanism. Therefore, mining is one of the pillars of the public chain, ensuring the security and availability of the network. Therefore, mining has been an indispensable infrastructure for the blockchain industry for a long time. Nowadays, the application of blockchain technology is encouraged, and mining as an infrastructure will also achieve rapid development. Besides, mining electricity consumption is gradually becoming legal. In the past few years, due to the small industry and small circle, the miners' production process was "running roughshod over the bush", and some miners used the electricity for special purposes, which also put the mining business in a dark area for a long time. However, in the second half of last year, many places in Ya'an and Ganzi, Sichuan, announced the construction of "hydropower consumption demonstration zones". Many mining companies signed up and successfully settled in, announcing that mining electricity consumption is moving towards compliance. Against this background, how should ordinary investors participate in mining? In fact, if investors find any of the above four links, they can get a one-stop mining service of "you contribute the money, I contribute the effort, and everyone shares the profit." Therefore, it is not difficult to enter the industry. What is difficult is to understand the industry situation and opportunities. New mining users must be fully familiar with the situation and make decisions before entering the market, so that they can get twice the result with half the effort.  The industry landscape is changing, where are the opportunities? Although there are opportunities for the policy environment to recover, the mining industry, which has been rapidly expanding for three years, is also facing unprecedented challenges. To sum up, the current challenges facing all practitioners include the industry entering a mature stage and mining profits declining. ; Mining machine manufacturers have insufficient production capacity ; Miners have to increase investment due to the high computing power of the entire network. At the same time, the return period has become longer. Mining can no longer make quick money. This has forced a group of "short-term" miners to retire, allowing the computing power to flow to large miners and mine owners. The industry has become further centralized, institutionalized and professionalized. For those who are still on the market, competition is still fierce. As a big player on the field, Maoqiu Technology has deep experience. Founded in 2017, Maoqiu Technology is positioned as a computing power service provider at the bottom of the blockchain, commonly known as a "mine". It specializes in providing operating power, space and even operation and maintenance services for mining machines.  Maoqiu Technology’s company headquarters is located in Chengdu. Source: Within half a year of Maoqiu Technology’s establishment, Maoqiu Technology received tens of millions of dollars in Series A financing led by Tsinghua Tongfang Fund Tongfang Houchi Capital, iResearch Capital, Yangtze River Financial Holdings and other institutions. As of June this year, Maoqiu Technology once again received hundreds of millions of yuan in Series A+ financing from well-known institutions. Just this Wednesday, Maoqiu Technology officially signed a 1 billion yuan credit cooperation agreement with the Agricultural Bank of China to promote the development of blockchain technology + smart agriculture. Talking about the changes in the mining landscape, Wang Mingliu, the head of Maoqiu Technology, lamented, “As the old saying goes, this is the best of times and the worst of times. 」Taking the "mine hosting" link where Maoqiu is located, the price of Fengshui electricity has increased from 5 cents/kWh to 6 cents/kWh in 2017, to 4 cents/kWh to 4.5 cents/kWh in 2018, to 2.5 cents/kWh last year and around 2 cents/kWh this year. 「I can say with absolute certainty that it will fall again next year. 」After counting the total load of existing mines and the overall production capacity of mining machines in China, Wang Mingliu found that the size of existing mines is far larger than actual needs. 「Now is what we call 'out of breath'. A large number of old mining machines like S9 will be shut down and removed from shelves after the flood season this month. ; Due to reasons such as giving way to 5G, the new Asic mining machine production capacity will not be able to be mass-produced in a short period of time to meet the needs of market upgrading. The memory of old Ethereum graphics card machines will be upgraded from 4G to 8G at the end of this year. Due to yield and quality control reasons, many miners will not take risks and spend money to upgrade, but will sell them. For example, 1,000 units will be sold for two to three hundred new 8G graphics card mining machines. In short, the number of machines and therefore the demand for hosting will drop significantly. 」  Mines owned by Maoqiu Technology, source: Intensified competition in the Maoqiu Technology industry will inevitably lead to the emergence of an oligopoly effect. 「This is a process that any emerging industry must go through, from the early barbaric growth to the return of value. The question is whether you can expand your base when you return. 」Wang Mingliu believes that he is the one who is well prepared for the winter. Judging from the data, Maoqiu Technology only had a load of hundreds of thousands of kilowatt-hours when it started in 2017. Although it made huge profits, the final total profit was not as big as it is now. Although the profit margin has become lower now, the basic market has increased in scale. 「In short, now is the time for practitioners to work hard and lay a solid foundation. We have formulated a series of transformation strategies. 」At this critical juncture, Maoqiu Technology has received huge investment from heavyweight investors. On the one hand, this shows that the investors affirm its professional capabilities and industry status. ; On the other hand, it is also providing it with sufficient ammunition and vast resources to cope with subsequent competition. More than competition, Maoqiu Technology shares the way to overcome the crisis through cooperation between the upstream and downstream industries.  How should the survivors compete and cooperate when the waves wash away the sand? Wang Mingliu said that the way Maoqiu Technology responds to industry changes is to build synergies with other links in the industry chain through strategic investment or in-depth cooperation to enhance the depth of its own business. For example, Maoqiu Technology will invest in mining machine manufacturers upstream. By combining the two, Maoqiu can boost the manufacturer's sales. In turn, the manufacturer can bring more hosting customers to Maoqiu Technology's mines. For another example, Maoqiu Technology invests in financial derivatives based on miners. Wang Mingliu is very optimistic about the development of mining finance. 「The demand for hedging among miners has been confirmed, and now financial products that earn interest on deposits are gradually becoming popular. It is conceivable that the penetration rate of finance will gradually deepen. 」 But for these crypto financial companies, because the industry lacks necessary supervision and the cost of default is relatively low, how to enhance the credit of the C-side is a problem. If you cooperate with Maoqiu Technology, you can obtain credit endorsement based on physical assets to some extent. Wang Mingliu explained, “As long as they are my custody customers, they can safely put the mined coins into our self-operated or strategic investment/partnered financial products without fear of running away. Because he can see that Maoqiu Technology has so many mines and mining equipment, plus my personal reputation and credibility inside and outside the industry, as well as the endorsement of our shareholders. If you run away, the cost of breach of contract will be obviously higher, right? Therefore, I hope that through the Maoqiu Technology brand, we can empower some truly imaginative and professional financial teams to provide miners with better financial derivatives services and make this industry more robust. 」In addition to proactive foreign investment and cooperation, Maoqiu Technology is also vigorously innovating its original products and services to make it more in line with the needs of more individuals and medium-sized investors. Originally, Maoqiu Technology’s business was divided into two parts. One was ToB, which mainly collaborated with some financial institutions of a certain scale, such as equity, guarantee, and financial leasing companies for “mining.” The other part is ToC, which mainly provides customized cloud mining products for high-net-worth individuals. When the customer's investment reaches more than 5 million, Maoqiu Technology will allocate funds according to their risk preferences, part of which will be used to invest in mining machines, and the other part will be used to build mines or machine locations that will apply electric loads to these machines. After the product upgrade, in ToB's joint mining products, according to the current situation of intensified competition in mine hosting, Maoqiu Technology will change the original "one dominant shareholder" or only a small number of shareholders model, and replace it with recruiting more small shareholders. The benefits brought by this are that on the one hand, investment risks are dispersed (both for Maoqiu and participating shareholders), and on the other hand, the problem of investment promotion can be effectively solved by introducing strategic partners. Wang Mingliu believes that this product is suitable for small mine owners and large miners. 「The current trend in mining is scale and institutionalization. If you build a mine with a load of 10,000 to 20,000, it may not be as economical and beneficial as if I built a mine with a load of 100,000 at once. But nowadays, if you don’t have that much money, you can invest in our mine. 」For large miners, there are two mining costs. One is the mining machine. The current sales price is relatively transparent. “The cost that everyone gets is quite different.」 ; Another item is the cost of electricity. Only by taking power upstream to build factories and quickly creating a scale effect can we further reduce costs and obtain a certain safety margin amid uncertainty. I believe that the many cognitions and strategies of Maoqiu Technology will have some inspiration for practitioners. These thoughts all stem from Wang Mingliu, a "big mine owner + super miner + determined Holder" who doesn't like to show his face. As a "newbie" in mining, understanding the habits and styles of miners is one of the basic skills for entering the industry.  Big miners must be "long-termists"」 Like many big miners, Wang Mingliu is powerful but keeps a low profile. Under his careful management, Maoqiu Technology has grown from a small team of a few people to an enterprise with 400 people. The computing power centers it manages are located in Sichuan, Yunnan, Xinjiang, Inner Mongolia and other places, with a total installed capacity of more than 500,000 units and an electricity load of nearly 1 million kilowatt hours.  Wang Mingliu gave a keynote speech at the 2020 Tianfu Forum. Source: Sichuan Chamber of Commerce. Not long ago, on October 20, the "2020 Hurun Rich List" was officially released. Wang Mingliu was on the list for the second time with a worth of 10.5 billion yuan. In the blockchain field, he is second only to Binance Zhao Changpeng (21 billion) and Bitmain Zhan Ketuan (11 billion), ranking among the "three richest people in crypto". At the same time, he is also the only post-80s generation in Sichuan Province with a net worth of over 10 billion. For Wang Mingliu, the continued increase in wealth is more of a change in numbers. The meaning he seeks is to lead the company's employees and friends around him to a new level of wealth accumulation. Although he often works overtime, Wang Mingliu still makes time for his hobbies: drinking tea with friends and preaching. According to Wang Mingliu, as a believer in Bitcoin, he still invests in Bitcoin on a monthly basis. 「This belief is now even stronger. In the post-epidemic era, central banks around the world are releasing funds one after another. In addition to gold, mainstream crypto-assets led by Bitcoin and Ethereum will definitely be the best safe-haven asset options. 」Under Wang Mingliu's unremitting preaching, many friends around him have been converted into the field. 「But the revolution has not yet succeeded. I hope to convert all the tens of billions (RMB) they have to make the entire industry bigger and better. Because this is not a matter of investing a few million, the minimum investment is 10 million. You can only 'penetrate' this scale slowly over time, haha. 」 Wang Mingliu is obviously optimistic about the future. 「Crypto assets will definitely become the only choice for human beings in personal asset allocation. 」he reiterated.     Come and "share, like, and watch" 👇How many opportunities have you missed this year? |

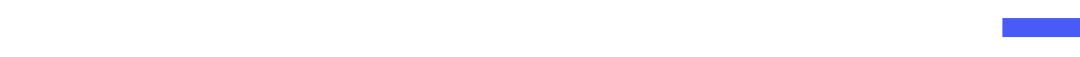

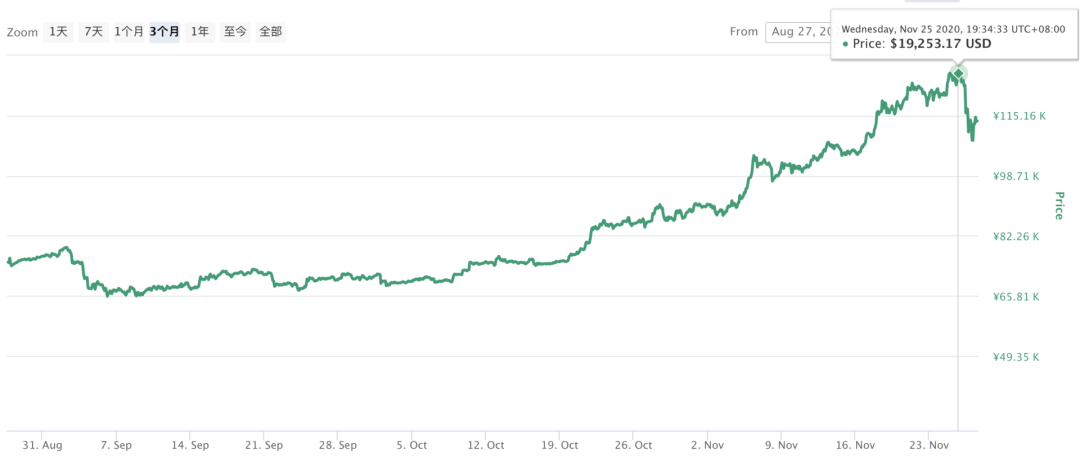

2025-10-19