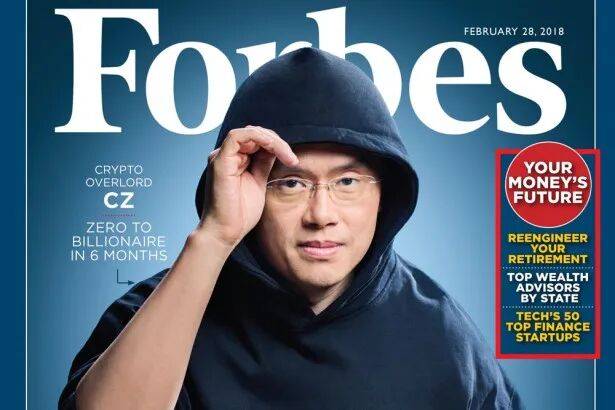

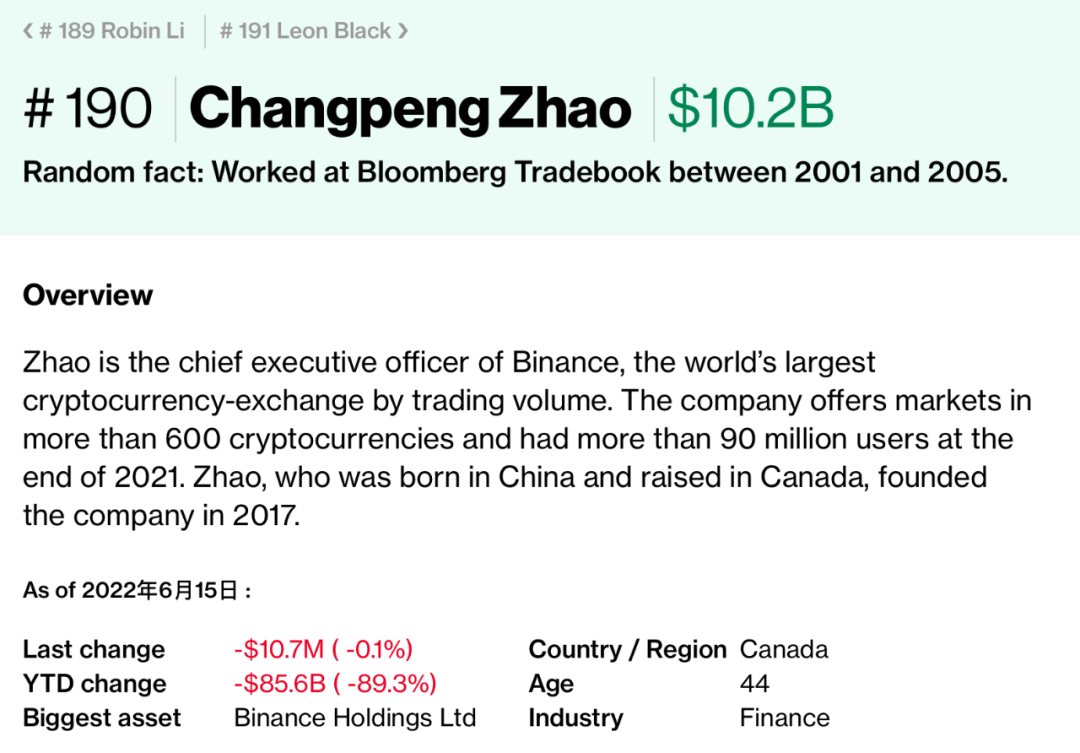

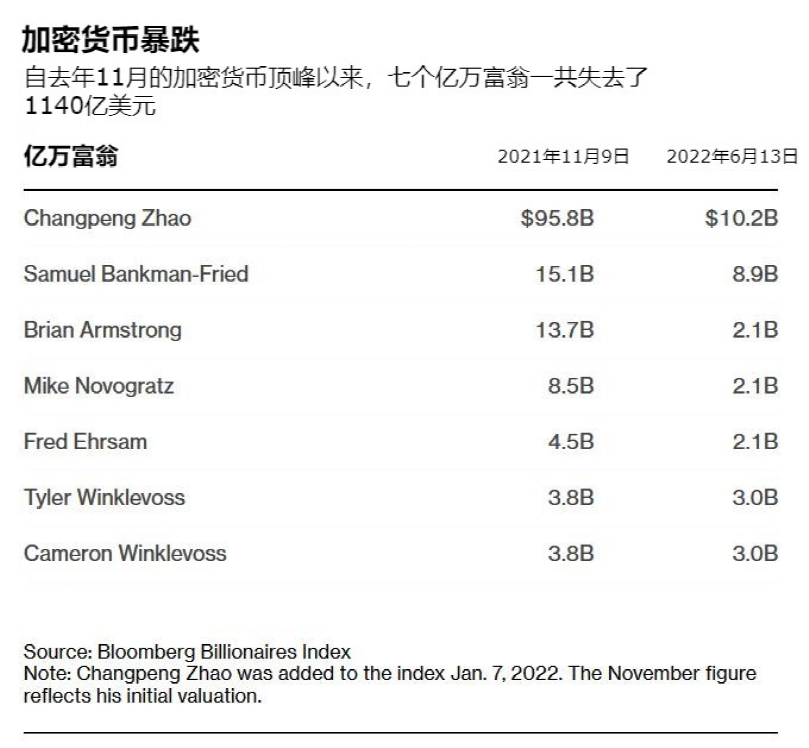

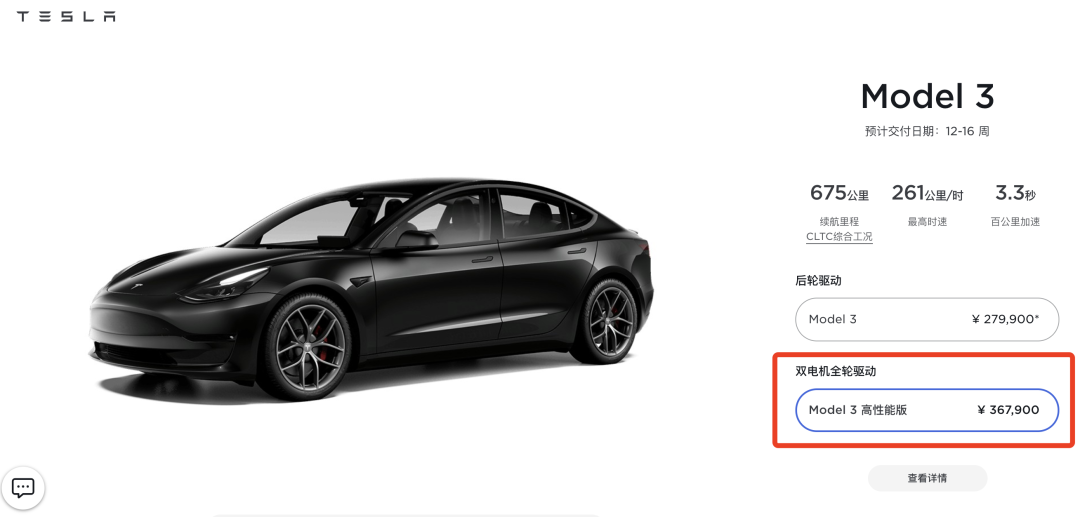

The recent decline in cryptocurrency is so tragic! Overnight, Bitcoin hit an 18-month low. At one time, nearly 280,000 people liquidated their positions, and about 6.5 billion funds evaporated! “The net worth of "the richest man in China" has shrunk by 90%, and Musk, the world's richest man, has also been trapped. And all this is not over yet, the collapse of the entire cryptocurrency market is still continuing.  A big crash, indiscriminate strangulation On June 14, Bitcoin plunged again, falling below the $21,000 mark, hitting a new low in 18 months.  What’s even more desperate is that Bitcoin has fallen by 70% from its historical high of $68,000 in November last year. And it’s almost all the way down, with no sign of recovery in sight. Bitcoin fell another 6.29% in the past 24 hours, Ethereum fell 7.73%, and most other cryptocurrencies also fell.  Of course, everyone has read a lot of the story of leek in the cryptocurrency circle in daily technology updates, but compared with this continuous plunge, it is somewhat "insignificant". According to data provider CoinMarketCap, the total market value of cryptocurrency has dropped from a peak of nearly $3 trillion in November last year to only about $975 billion on June 14, a drop of as much as 69%.  Zhao Wei, a senior researcher at the Oyi Research Institute, told Technology Daily that one of the factors behind the plunge was the de-anchoring of stETH, which in turn triggered a further plunge in the price of ETH. Lido was originally promised to be able to exchange stETH for ETH2.0 at a 1:1 ratio. However, due to a violent sell-off by an institution, stETH became destabilized. This will inevitably lead to a large amount of ETH being "hunted" for stETH, which will lead to a series of collapses. “"Blood loss" and "plummet" have become the norm of cryptocurrency in recent times. A group of big guys who have achieved financial freedom with cryptocurrency have naturally "wiped out".  “China’s richest man’s net worth has shrunk by nearly 90% The person who has lost the most is undoubtedly Binance boss Changpeng Zhao, who just became the richest Chinese person in the world last year. According to the Bloomberg Billionaires Index, as of June 15, Zhao Changpeng’s net worth was only US$10.2 billion, an evaporation of 89.3%, a loss of US$85.6 billion, or approximately 577 billion yuan.  The amount of Zhao Changpeng's wealth evaporated ranks first among all the rich, making him the world's richest man.  Some netizens joked that this was "returning to poverty overnight." In the Bloomberg Billionaires Index, the wealth of seven cryptocurrency billionaires has shrunk by a total of $114 billion.  Musk, the world’s richest man, has also been tricked. Previous media analysis stated that Tesla bought US$1.5 billion in Bitcoin at the beginning of 2021, at a price of approximately US$35,000 per coin. Based on this cost calculation, Musk and Tesla are currently deeply trapped. The losses of these rich people are just temporary wealth on paper. They are still rich. But this Bitcoin tragedy, if spread to a country, may be a devastating disaster. In September 2021, the Central American country El Salvador, all in Bitcoin, became the first country in the world to use Bitcoin as a legal currency.  The continued collapse of Bitcoin has also dragged the country into the abyss. Some media reported that the value of Bitcoin speculated in El Salvador has shrunk by more than 65%, with losses exceeding US$56 million. The country's already stretched foreign exchange reserves, against the backdrop of the halving of Bitcoin prices, directly threaten the entire country's finances.  But the president of El Salvador is quite stubborn. He hinted on Twitter that he would continue to buy Bitcoin on dips. The president also likes to express his views on governance on Twitter. He once posted: "As long as you buy the dip, they can't beat you. ”  The first country to go bankrupt due to Bitcoin may be seen by everyone in the near future.  Buffett says Bitcoin is rat poison Just on June 14, Microsoft founder Bill Gates criticized the cryptocurrency project when attending a climate conference, saying that the cryptocurrency project was a scam based on the "greater fool theory." “The "Boss Fool Theory" believes that as long as you find someone who is dumber than you to take over your assets, you can still make money even if your assets are worthless garbage. As early as May 1 this year, at the Berkshire Hathaway annual shareholder meeting, Buffett also specifically warned about the issue of Bitcoin.  Buffett himself explained in detail why he doesn’t think Bitcoin has value. He said: Bitcoin is not a productive asset and does not produce anything tangible. And he also made it clear that even if all the Bitcoins in the world were worth only $25, he would not buy them. “Because what can I do with it? I have to sell them one way or another. Bitcoin does not generate any value. Apartments generate rent, and farms produce food. ” Buffett's partner Munger seems to have a more radical attitude towards Bitcoin. Munger said: “In my daily life, I try to avoid doing stupid and evil things that make me look bad in front of others, and Bitcoin fits all three. First, investing in Bitcoin is foolish because its value could still drop to zero. Second, it is evil because it undermines the Federal Reserve System. Third, some countries ban the use of Bitcoin, which is a smart move but also makes us look awkward. ” In fact, the two have always had a negative attitude towards cryptocurrencies, with Buffett calling cryptocurrencies "strong rat poison."  Cherish your wallet and stay away from currency speculation How toxic is Bitcoin? In November 2021, Bitcoin reached its historical peak of $68,991. If you had bought one Bitcoin at a high price, you would have lost about 320,000 yuan now. If you work harder, you will lose a Tesla Model 3 high-performance version.  Many new Bitcoin players enter with the mentality of "getting rich suddenly": “The currency circle can make money much faster than funds and stocks.” “It’s better than depositing money in the bank.” “The threshold for transactions in the currency circle is low, and people like me with relatively small capital can also have the opportunity to make a fortune.” Gamblers at the cryptocurrency poker table play with high risks. When you make money, you spend a lot of time and alcohol, but when you lose everything and go bankrupt, you can only go to the rooftop to enjoy the breeze. U.S. Treasury Secretary Janet Yellen has said that Bitcoin is a "highly speculative asset" that is highly speculative and investors should be careful. The editor of Ke witnessed too many stories of sudden fortunes and losses in cryptocurrency. He couldn't sleep at night. After reading carefully for half the night, he saw from the cracks in the story that there was one sentence written all over the book: Protect your wallet and stay away from currency speculation. •END• If you need to reprint original articles, please contact WeChat: KJMRTS88 Welcome to click on the daily push video account of Science and Technology to watch the latest videos.~ ↓↓↓  |

2025-10-19