41471

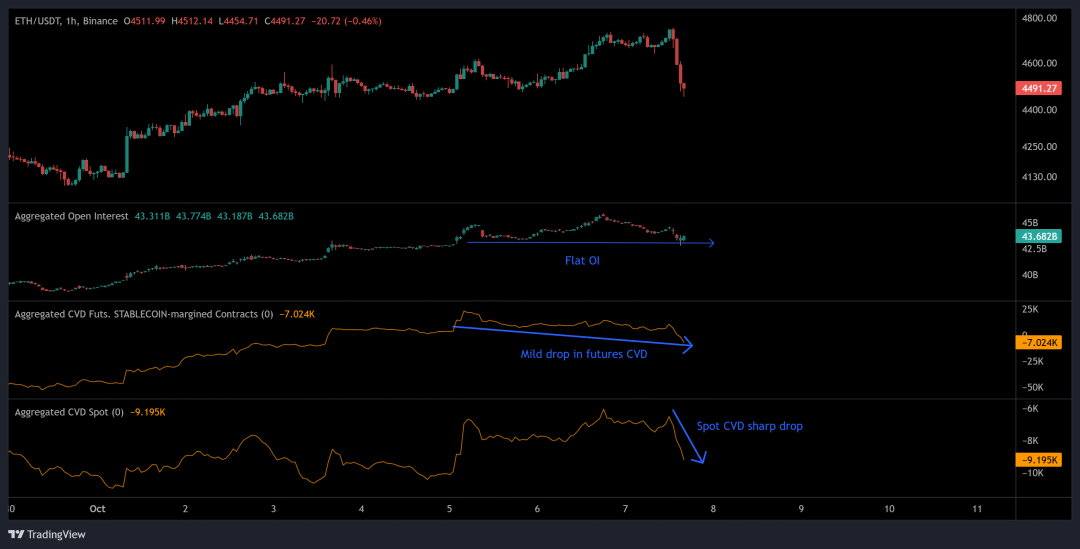

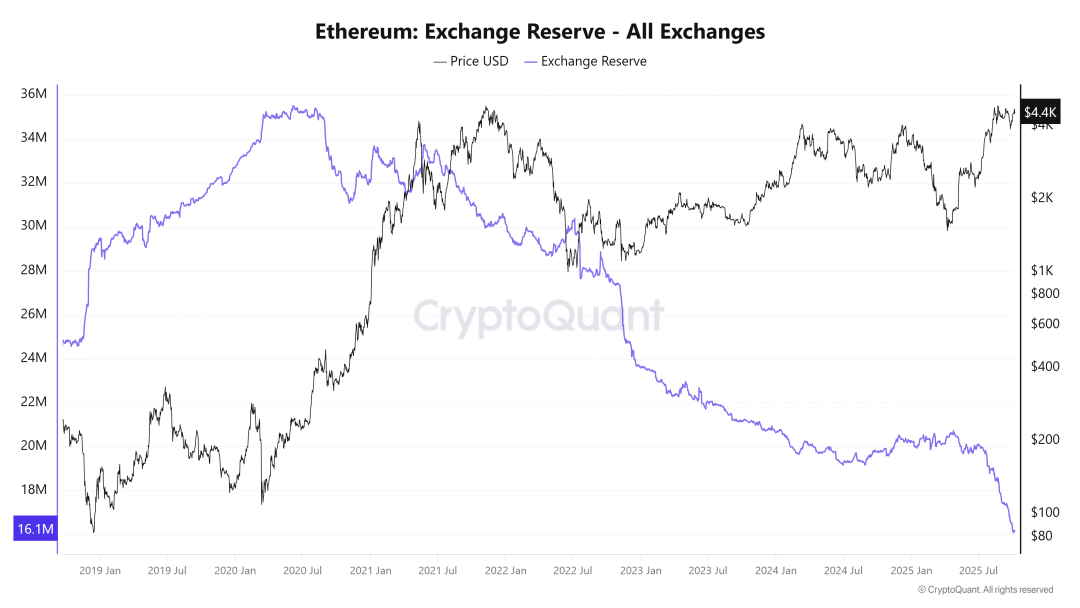

This column is dedicated to providing high-quality Web3 articles. You can scroll to the end of the article and continue to follow us👇 The recent price action of Ethereum (ETH) has attracted widespread attention in the market. During this price fluctuation, ETH once hit the resistance level of $4,800, but failed to break through. Subsequently, there was a sharp correction of 3% on Tuesday, and the price fell below $4,500. This price drop comes against the backdrop of bearish divergence on the four-hour chart. Bearish divergence is usually an important technical signal, indicating that the power of buyers is gradually waning, often heralding the arrival of a local top or short-term reversal. In Ethereum's current market, the emergence of bearish divergence has made the market worried about its subsequent trend. Looking at on-chain and derivatives data, the picture presents mixed signals. The cumulative cumulative volume delta (CVD) of the spot has dropped significantly, which means that there is net selling pressure in the spot market, and many spot buyers have chosen to take profits. However, futures open interest and futures CVD remain elevated, suggesting that leveraged traders remain active and prepared for price volatility.  Such market conditions typically attract liquidity-driven investors who wait for the right moment to enter the market, rather than triggering impulsive trading behavior. During price action, the vicinity of $4,400 is a key area where a large number of stop-loss orders are usually concentrated. If the price touches this area, it could trigger a short-term price reset. If ETH is able to rebound strongly from the $4,400 area, the previous bearish setup will be invalidated, which could signal a continuation of the bullish trend for Ethereum prices this week. However, if ETH fails to hold this area, the correction may extend further into the $4,250 to $4,100 range. Within this range, four-hour and one-day order blocks occur simultaneously, and these overlapping areas typically represent areas of high demand where large buy-side orders have previously been concentrated, serving as key levels for potential trend reversals. Liquidity comparison of Ethereum and BitcoinIn the cryptocurrency market, Bitcoin and Ethereum are two coins that have attracted much attention. In recent years, Bitcoin and Ethereum have shown different trends in response to changes in economic liquidity. The U.S. M2 money supply, a measure of economic liquidity, has expanded to a record $22.2 trillion, according to XWIN Research. Bitcoin has surged more than 130% since 2022 in response to this wave of liquidity, while Ethereum has only risen 15%, highlighting Ethereum's "liquidity lag" phenomenon. However, some on-chain indicators suggest that Ethereum may be gradually catching up. Reserves have fallen to approximately 16.1 million ETH, down more than 25% since 2022, reflecting continued decline in seller pressure. Net exchange flows remain negative, indicating that ETH is moving into self-custody and staking, reducing the available supply on the market.  This trend of decreasing supply could have a positive impact on the price of Ethereum. When there is less supply on the market, prices tend to increase if demand remains stable or increases. Therefore, although Ethereum currently suffers from "liquidity lag", its price is expected to see new growth as supply decreases and market demand changes. Ethereum market prospects and potential risksFrom the perspective of market prospects, there are many possibilities for the future trend of Ethereum. If Ethereum can successfully break through the $4,800 resistance level and maintain its upward momentum, it may attract more investors to the market and further push the price upward. Cryptocurrency trader Skew noted that the recent rally marked the “fourth click” in the $4,700-$4,800 area. If ETH can hold this area, the market will take on a rather bullish tone. Otherwise, a deeper pullback could form higher lows, setting the stage for the next leg higher. However, the Ethereum market also faces some potential risks. First, the bearish divergence signal on the technical level still exists, and if the market sentiment continues to be depressed, it may trigger more selling behavior and cause the price to fall further. Secondly, changes in the macroeconomic environment may also have an impact on the price of Ethereum. For example, policy changes by the U.S. government and the strengthening of regulatory measures may lead to increased market volatility. Decisions by the U.S. Securities and Exchange Commission (SEC) will also have an important impact on the Ethereum market. In the context of the current U.S. government shutdown, the SEC’s decision deadline for the Canary Litecoin ETF has passed, but a decision has not yet been made, which adds to market uncertainty. If the SEC takes strict regulatory measures against Ethereum-related products or projects, it may have a negative impact on the Ethereum market. The Ethereum market also faces security risks. For example, Unity Android vulnerabilities may lead to the theft of players' encrypted wallets, which will not only affect investor confidence but may also trigger market panic. For Ethereum developers, continuous innovation and improvement are needed to improve the competitiveness of Ethereum. They can explore new application scenarios, develop more decentralized applications (DApps), and attract more users and developers to join the Ethereum ecosystem. In the current market environment, Ethereum's price fluctuations are also affected by the overall trend of the global cryptocurrency market. If the prices of other mainstream cryptocurrencies such as Bitcoin fluctuate significantly, it may also lead to changes in the price of Ethereum. Therefore, investors need to pay attention to the dynamics of the entire cryptocurrency market and conduct comprehensive market analysis. The development of Ethereum is also closely related to the innovation and application of blockchain technology. As blockchain technology continues to advance, Ethereum may usher in more development opportunities. For example, the application of blockchain in finance, supply chain, medical and other fields continues to expand. As an important blockchain platform, Ethereum is expected to play a greater role in these fields. The future development of the Ethereum market is full of uncertainties. Investors need to maintain a cautious attitude, fully understand market risks, and pay attention to the technical development and market dynamics of Ethereum to make reasonable investment decisions. For the entire cryptocurrency market, it is necessary to find a balance between innovation and regulation to promote the healthy and stable development of the market. The Ethereum market is a dynamic and challenging one. Whether investors, developers or regulatory agencies, they all need to work together to create a good environment for the development of Ethereum and promote the application and development of blockchain technology on a global scale. In future development, Ethereum is expected to play a more important role in the cryptocurrency market, but it also needs to overcome various difficulties and challenges to achieve sustainable development. END About KnowHere Get more information Official website: https://www.knowhere.io Twitter:https://twitter.com/knowhere_io Discord: http://discord.gg/knowhereio Youtube:https://www.youtube.com/@knowhere_io Telegram::t.me/knowhere_official As a leading Web3.0 media platform, KnowHere is committed to promoting high-quality Web3.0 content Contact us  |