83263

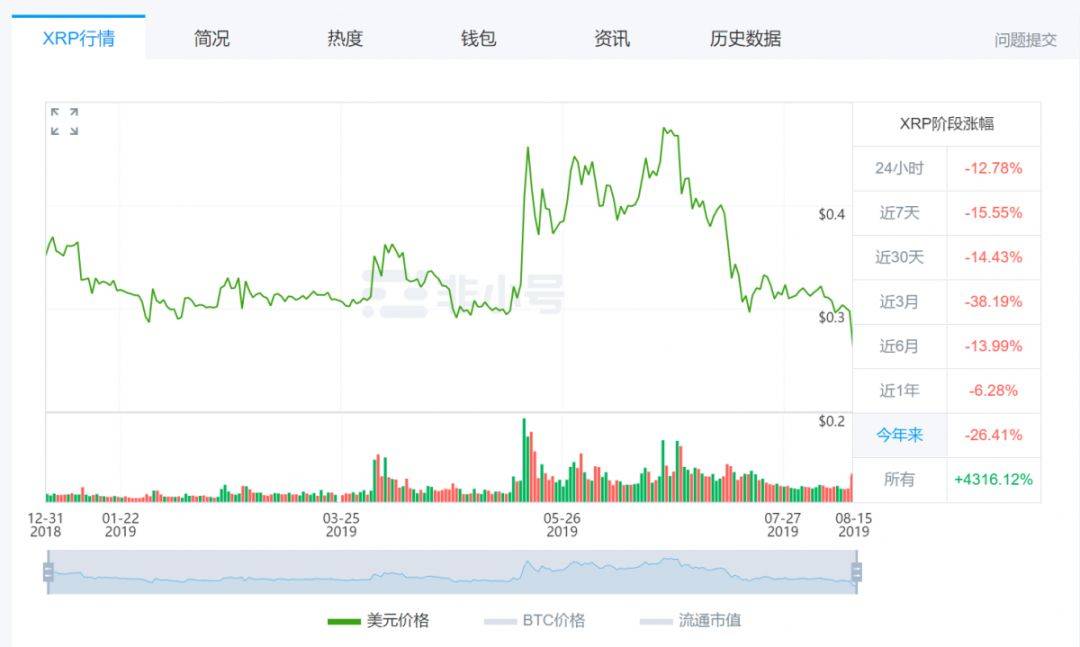

Cryptocurrencies have once again become a buzzword in financial markets amid massive declines in global stock and foreign exchange markets. Investors have been seeking shelter from the escalating U.S.-China trade war, a potential currency war, increasingly aggressive easing by central banks and geopolitical tensions. Nei Shenjun's previous article "Can Bitcoin Help Your Investments Survive the Financial Crisis?" 》, reviews how Bitcoin has responded to past crises, and further analyzes its performance as a new safe-haven asset. However, XRP has been lagging behind other major cryptocurrencies amid the hype in the crypto market. Especially today, as BTC plummeted, XRP also plummeted. According to Huobi’s real-time data statistics, today’s opening price was US$0.2922, with the lowest falling to US$0.223, and the largest drop reaching 23%. As of 14:00 p.m., the price of XRP was $0.2568, a decrease of 12%. 01What happened to XRP? Why did it fall so sharply? More broadly, more major international companies are joining the crypto space, however, some say this could jeopardize XRP’s prospects. But this is only a foreign threat, and internal worries are the decisive factor that hinders its price increase. ➤Internal concerns: XRP’s implementation and circulation are both big problems The two charts below compare the year-to-date performance of XRP and BTC, and even with an overall bullish June, XRP has fallen short of expectations. As of today (August 15), BTC has increased by more than 160% after several rounds of adjustments this year, and the highest increase in June this year reached 251%. On the other hand, XRP is down 26% year to date.   Before exploring the possible reasons behind XRP’s price fluctuations this year, it’s important to review what Ripple is and how XRP is being used. Ripple is a virtual currency issued by OpenCoin, called Ripple Credits, also known as XRP, and its Chinese name is Ripple. Ripple is the world's first open payment network. Through this payment network, you can transfer any currency. It is simple, easy and fast. Transaction confirmation is completed within a few seconds. Transaction fees are almost zero. There are no so-called inter-bank, long-distance and cross-border payment fees. Ripple open payment system is a virtual currency network (distributed P2P clearing network) and future electronic payment platform. In 2004, Ryan Fugger launched the first implementation version of Ripple. Its goal was to build a decentralized virtual currency system that allowed anyone to create their own currency. Ripple is currently developed, operated and maintained by OpenCoin Company (currently renamed RippleLabs). Ripple consists of two parts: the remittance platform (RippleNet) and its preferred currency (XRP). The system is designed to provide financial institutions and payment service providers with a convenient international payment and transfer platform. XRP is a digital asset used for value transfer. It simplifies transactions between different cryptocurrencies and fiat currencies, aiming to reduce processing time with minimal transaction fees. The cross-border transaction solutions provided by Ripple include xCurrent, xRApid, and xVia. The most important one is xCurrent. xCurrent mainly establishes distributed ledgers between banks and uses intermediary banks as intermediaries to complete cross-border transfers. It mainly provides cross-border transaction services between banks. It is also the main product based on the current cooperation between Ripple and other financial institutions. Although xCurrent uses blockchain technology, it does not need to use Ripple currency. The number of customers that have established partnerships with Ripple Net has exceeded 200, and a large number of investment banks are using Ripple's services, such as Standard Charter, Santander, and Bank of Tokyo-Mitsubishi UFJ (MUFG). And Ripple is currently signing about two new financial institutions every week. However, among the financial institutions that have established partnerships with Ripple, the vast majority do not use XRP. The excessive issuance of XRP is also the reason why its price has been sluggish. In terms of technology, XRP does not fully adopt blockchain technology, which makes it different from Bitcoin. Its algorithm is called the Ripple Protocol Consensus Algorithm (RPCA). This means that while Bitcoin is mineable, XRP is not. According to data from CoinMarketCap.com, there are currently 100 billion XRP in the world, of which about 25%, or 4.28 billion XRP, is in circulation. Ripple owns more than half of the total supply of XRP. Although Ripple intends to improve the poor adoption of XRP at this stage, because Ripple holds a large amount of XRP coins, XRP has long been questioned by "high control". The process of promoting XRP circulation is not easy, and it cannot be easily achieved simply by relying on strong partners. On August 5, the Ripple community launched a petition calling for half of XRP to be destroyed to save the currency price. The petition, started by trader Crypto Bitlod, who has more than 100,000 followers on Twitter, currently has more than 500 signatures. The petition recommends that Ripple no longer releases XRP to the crypto market, stating that this will help the price increase. He said, “Ripple continues to dump billions of XRP on us, causing prices to plummet! Of course, we know that XRP is a solid currency with huge potential, but this behavior needs to stop! ” Ripple’s escrow system holds 55 billion XRP (55% of its 100 billion supply) divided among 1 billion accounts. Each account is unlocked monthly and some or all of the XRP is sold at Ripple's discretion. While Ripple recently announced that its selling activity will continue based on its assessment of market conditions, the pace may be slower – hopefully this will preserve the price of XRP. But the community wasn't happy about it. Obviously, if every rise in XRP becomes an opportunity for Ripple to "suck blood", this is an extremely irresponsible approach to the majority of investors. ➤ Foreign invasion: market competition is becoming increasingly fierce The transfer of funds between institutions is at the core of Ripple, which makes Ripple stand out. However, this could also trigger uncertainty for the company, as currency trading is a lucrative business and many big players want to enter the market. The Federal Reserve may be the latest contender. Recently, the Federal Reserve announced that it plans to develop a faster payments system that would allow banks to exchange currency. The new system will allow bill payments, paychecks and other common consumer or business transfers to be made instantly, 24 hours a day. Ripple was recently selected to serve on the steering committee of the U.S. Federal Reserve’s (Fed) Faster Payments Task Force, sparking rumors that the company’s technology could be used to power the Fed’s new system. Shortly after the announcement, Dilip Rao, global head of infrastructure innovation at Ripple, retweeted the news. The Fed’s announcement follows the disclosure of Facebook’s Libra and JPMorgan Chase’s JPM Coin, both of which are designed and built for faster money transfers. Ripple says neither coin will affect its efforts, but others worry that the company could lose market share and that the impact could spread to XRP. Ripple is certainly not the only company that has entered the space, with R3, SWIFT and other payments startups making the competition even fiercer. Although more than 100 financial institutions have been using Ripple’s Rippleet and RPCA to move funds around the world, most of them do not use XRP as a medium. However, Ripple’s new partnership with remittance giant MoneyGram is expected to give xRapid, an XRP-based cross-border payments solution, a huge boost, and the company has revealed that it is already operational. The financial world has been trying to revive the banking industry with the help of blockchain and other emerging technologies. Companies outside the traditional financial system, such as Ripple, have been at the forefront of this game. However, the old world is quickly catching up, and other tech giants like Facebook are eager to get into the space. As a payment solutions provider, Ripple faces stiff competition. As with all cryptocurrencies, institutional interest is key to XRP adoption. It will be interesting to see if Ripple can further use XRP in its payment and transaction solution services and continue to spark interest. ➤ Future: Potential regulatory risks intensify A group of XRP investors filed a new lawsuit against Ripple on August 5. In May 2018, XRP investors filed a class action lawsuit against the cryptocurrency company Ripple, claiming that the company violated state and federal securities laws. Investors believe there is a direct connection between Ripple and XRP. At the same time, according to the Howey test, XRP should be considered a security if it involves investment and has reasonable profit expectations. At the time, Ripple’s head of corporate media, Tom Channick, denied this view, saying that it would be up to the U.S. Securities and Exchange Commission (SEC) to decide whether XRP is a security, but we still believe that XRP should not be classified as a security. It is reported that the lawsuit update on August 5 is an important supplement to the lawsuit request in May 2018. Investors believe that whether XRP is defined as a security should refer to the "Digital Asset Investment Contract Analysis Framework" just released by the SEC in April 2019. Although this framework is only a non-legal guidance framework, the court should rely on the Howey test results mentioned in the framework as an important reference. Investors claim that buying XRP requires Bitcoin or Ethereum, that XRP buyers have invested funds in a common enterprise, that XRP investors have reasonable expectations of profits, and that the success of XRP requires the efforts of Ripple and others, which fully meets the above criteria. In addition to asking the court to refer to the Analytical Framework for Digital Asset Investment Contracts, the supplement also raises the case that Ripple violated California’s False Advertising and Unfair Competition Laws by making deceptive representations about the origin, circulation supply of XRP. Finally, the investors asked the court to support the lawsuit as a class action and determine that XRP is a security. The defendant's unregistered sale of XRP violated applicable laws and award damages to the plaintiff and other members. It is worth noting that some foreign media stated that, with reference to Kik Interactive’s response to the Securities and Exchange Commission, starting from August 5, Ripple must respond to the above issues within 45 days (before September 19). If XRP is eventually recognized as a security, it will most likely be banned from sale, Ripple will also face sky-high fines, and the entire cryptocurrency market will face turmoil. Perhaps, Ripple is a good startup, but XRP is not a valuable investment product. END  BaiMediaChain talks about cooperation↓   Past Issues▼Hot Articles ★ Five Reasons Why Bitcoin Can’t Be Banned ★ LianTianXia Special Topic Series No. 1 "Coin Circle Micro-Business" Justin Sun ★ 68% of millionaires globally will invest in cryptocurrencies by 2022 ★ ETH plummeted more than 40% in January, and "Adou cannot afford to support it"” ★ Facebook, Bakkt, and Fidelity are rapidly deploying in the encryption field, urging the United States to speed up regulation ★ With the help of big funds and the support of big companies, Ethereum may explode at any time in the future.     |